UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-17272

TECHNE CORPORATION

(Exact name of Registrant as specified in its charter)

| Minnesota | 41-1427402 | |

| (State of Incorporation) | (IRS Employer Identification No.) |

| 614 McKinley Place N.E., Minneapolis, MN | 55413-2610 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: (612) 379-8854

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.01 par value

Name of each exchange on which registered: The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrants has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the Registrant, based upon the closing sale price on December 31, 2013 as reported on The Nasdaq Stock Market ($94.67 per share) was approximately $2.7 billion. Shares of Common Stock held by each officer and director and by each person who owns 5% or more of the outstanding Common Stock have been excluded.

Shares of $0.01 par value Common Stock outstanding at August 22, 2014: 37,007,203

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for its 2014 Annual Meeting of Shareholders are incorporated by reference into Part III.

| Page |

||||||

| PART I | ||||||

| Item 1. | 1 | |||||

| Item 1A. | 10 | |||||

| Item 1B. | 15 | |||||

| Item 2. | 15 | |||||

| Item 3. | 16 | |||||

| Item 4. | 16 | |||||

| PART II | ||||||

| Item 5. | 16 | |||||

| Item 6. | 18 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| Item 7A. | 28 | |||||

| Item 8. | 30 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

48 | ||||

| Item 9A. | 48 | |||||

| Item 9B. | 49 | |||||

| PART III | ||||||

| Item 10. | 50 | |||||

| Item 11. | 50 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

50 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

50 | ||||

| Item 14. | 51 | |||||

| PART IV | ||||||

| Item 15. | 51 | |||||

| SIGNATURES | 52 | |||||

i

OVERVIEW

Techne and its subsidiaries, collectively doing business as Bio-Techne (Bio-Techne, we, our, us or the Company) develop, manufacture and sell biotechnology products and clinical diagnostic controls worldwide. With our deep product portfolio and application expertise, Bio-Techne is a leader in providing specialized proteins, including cytokines and growth factors, and related immunoassays, small molecules and other reagents to the research, diagnostics and clinical controls markets.

A Minneapolis, Minnesota-based company, Bio-Techne originally was founded as Research and Diagnostic Systems, Inc. (R&D Systems) in 1976, initially producing hematology controls and calibrators for primary use in clinical settings. Techne Corporation, a public entity at the time and currently the parent company, acquired R&D Systems in 1984 and through this action made R&D Systems a public company. The initial products focused on the hematology blood controls and calibrators market but soon expanded through the creation of the Biotechnology Division, to include reagents used in life science research. A series of acquisitions further expanded the product portfolio. These included the Amgen research business in 1991, the Genzyme research business in 1997, Fortron Bio Science, Inc. and BiosPacific, Inc. (BiosPacific) in 2005, and Boston Biochem, Inc. and Tocris Holdings Limited (Tocris) in 2011. In fiscal 2014, we further strengthened our clinical controls solutions by acquiring Bionostics Holdings Limited (Bionostics), and our biotechnology segment offerings were increased by the recent acquisition of Shanghai PrimeGene Bio-Tech Co. (PrimeGene), and an agreement to invest in and possibly acquire CyVek, Inc. (CyVek). With these recent investments, we will be able to scale our business and expand into new product and geographic markets.

Recognizing the importance of a unified and global approach to meeting our mission and accomplishing our strategies, in fiscal 2014 we implemented a new global brand, Bio-Techne. The Bio-Techne brand is derived from the Greek words “Bio,” or “life,” and “Techne,” or “the application of knowledge to practical matters.” The combination of these words and their meanings capture the essence of Bio-Techne, its products and mission. The acquisition of various brands over the years drove the need for an umbrella branding strategy that could hold all of the acquired assets. The Bio-Techne name solidifies the new strategic direction for the Company along with unifying and positioning all of our brands under one complete portfolio.

With these strategic efforts, as well as the establishment of dedicated subsidiaries in Europe and Asia, we now operate globally along with offices in several locations in the United States, Europe and China. Today, our product line extends to over 24,000 products, 95% of which are manufactured in-house. While maintaining our core strengths in cytokines and immunoassays, we also develop antibodies, cell selection and multicolor flow cytometry kits, multiplex assays, biologically active compounds, and stem cell products and kits.

We are committed to providing the life sciences community with innovative, high-quality scientific tools to better understand biological processes and drive discovery. We intend to build on Bio-Techne’s past accomplishments, strong reputation and financial position by executing strategies that position us to become the standard for biological content in the research market, and to leverage that leadership position to enter the diagnostics and other adjacent markets. Our strategies include:

| • | Continued innovation in core products. Through collaborations with key opinion leaders and participation in scientific discussions and associations, we expect to leverage our continued significant investment in our research and development activities to be first-to-market with quality products that are at the leading edge of life science researchers’ needs. |

| • | Investments in targeted acquisitions. We intend to leverage our strong balance sheet to gain access to new technologies and products that improve our competitiveness in the current market and allow us to enter adjacent markets. |

| • | Expansion of geographic footprint. We will continue to expand our sales staff and distribution channels globally in order to increase our global presence and make it easier for customers to transact with us. |

1

| • | Realignment of resources. In recognition of the increased size and scale of the organization, we intend to redesign our development and operational resources to create greater efficiencies throughout the organization. |

| • | Talent recruitment and retention. We will recruit, train and retain the most talented staff to implement all of our strategies effectively. |

OUR PRODUCTS AND MARKETS

Currently Bio-Techne operates worldwide and has two reportable business segments, Biotechnology and Clinical Controls, both of which serve the life science and diagnostic markets. The Biotechnology reporting segment develops, manufactures and sells biotechnology research and diagnostic products world-wide. The Clinical Controls reporting segment develops and manufactures controls and calibrators for the global clinical market. In fiscal 2014, net sales from Bio-Techne’s Biotechnology segment were 84% of consolidated net sales. Bio-Techne’s Clinical Controls segment net sales were 16% of consolidated net sales for fiscal 2014. Financial information relating to Bio-Techne’s segments is incorporated herein by reference to Note L to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Biotechnology Segment

Through our Biotechnology segment, we are one of the world’s leading suppliers of specialized proteins, such as cytokines, growth factors, immunoassays, antibodies and related reagents, to the biotechnology research community. The proteins are produced naturally in minute amounts by different cell types and can be isolated in a pure form either from the same cells or produced through recombinant DNA technology. With the acquisition of Tocris in April 2011, we added chemically-based products to our Biotechnology segment. These small compounds, sold in highly purified forms typically with agonistic or antagonistic properties in a variety of biological processes, allow customers access to a broad range of compounds and biological reagents to meet their life science research needs. Our combined chemical and biological reagents portfolio provides new tools which customers can use in solving the complexity of important biological pathways and glean knowledge which may lead to a fuller understanding of biological processes and ultimately to the development of novel strategies to address different pathologies.

Currently, the majority of the protein products are produced by laboratory processes that use recombinant DNA technology, while our chemically-based products are produced using available chemicals. Consequently, raw materials are readily available for most of our products in the Biotechnology segment.

Biotechnology Segment Products

Proteins. Cytokines, growth factors and enzymes, extracted from natural sources or produced using recombinant DNA technology, are developed and manufactured in house. All protein products are produced to the highest possible purity and characterized to ensure the highest level of biological activity. The growing interest by academic and commercial researchers in cytokines is largely due to the profound effect that tiny amounts of a cytokine can have on cells and tissues. Cytokines are intercellular messengers and, as a result, act as signaling agents by interacting with specific receptors on the affected cells and trigger events that can lead to significant changes in a cell behavior. For example, cytokines can induce cells to acquire more specialized functions and features (differentiation) or can play a key role in attracting cells at the site of injury, inducing them to grow and initiate the healing process. Unregulated cytokine production and action can have non-beneficial effects and lead to various pathologies. Enzymes are proteins which act as biological catalysts that accelerate chemical reactions. Most enzymes, including proteases, kinases and phosphatases, are proteins that modify the structure and function of other proteins and in turn affect cell behavior and function. Additionally, both enzymes and cytokines have the potential to serve as predictive biomarkers and therapeutic targets for a variety of diseases and conditions including cancer, Alzheimer’s, arthritis, autoimmunity, diabetes, hypertension, obesity, inflammation, AIDS and influenza.

2

Antibodies. Antibodies are specialized proteins produced by the immune system of an animal that recognize and bind to target molecules. Bio-Techne’s polyclonal antibodies are produced in animals (primarily goats, sheep and rabbits) and purified from the animals’ blood. Monoclonal antibodies are derived from immortalized rodent cell lines using hybridoma technology and are isolated from cell culture medium. The flow cytometry product line includes fluorochrome labeled antibodies and kits that are used to determine the immuno-phenotypic properties of cells from different tissues.

Immunoassays. We market a variety of immunoassays on different testing platforms, including a microtiter-plate based kit sold under the trade name Quantikine®, multiplex immunoassays based on encoded bead technology and immunoassays based on planar spotted surfaces. All of these immunoassay products are used by researchers to quantify the level of a specific protein in biological fluids, such as serum, plasma, or urine. Protein quantification is an integral component of basic research, as potential diagnostic tools for various diseases and as a valuable indicator of the effects of new therapeutic compounds in the drug discovery process.

Immunoassays can also be useful in clinical diagnostics. We have received Food and Drug Administration (FDA) marketing clearance for erythropoietin (EPO), transferrin receptor (TfR) and Beta2-microglobulin (ß2M) immunoassays for use as in vitro diagnostic devices.

Small Molecule Chemically-based Products. These products include small natural or synthetic chemical compounds used by investigators as agonists, antagonists and/or inhibitors of various biological functions. Used in concert with other Company products, they provide additional tools to elucidate key pathways of cellular functions and can provide insight into the drug discovery process.

Recent acquisitions and investments made in fiscal 2014 and 2015 will further expand and complement Bio-Techne’s current product offerings in the Biotechnology segment. For additional information regarding our investments and acquisitions, see “Acquisitions and Investments” under this Item 1.

Biotechnology Segment Customers and Distribution Methods

We sell our biotechnology products directly to customers who are primarily located in North America, Western Europe and China. In January 2014, we entered into a sales and marketing partnership agreement with Fisher Scientific in order to bolster our market presence in North America and leverage the transactional efficiencies offered by the large Fisher organization. We also sell through third party distributors in China, southern Europe and in the rest of the world. Our sales are widely distributed, and no single end-user customer accounted for more than 10% of Biotechnology’s net sales during fiscal 2014, 2013 or 2012.

Biotechnology Segment Competitors

The worldwide market for protein related and chemically-based research reagents is being supplied by a number of companies, including GE Healthcare Life Sciences, BD Biosciences, Merck KGaA/EMD Chemicals, Inc., PeproTech, Inc., Santa Cruz Biotechnology, Inc., Abcam plc., Sigma-Aldrich Corporation, Thermo Fisher Scientific, Inc., Cayman Chemical Company and Enzo Biochem, Inc. Market success is primarily dependent upon product quality, selection and reputation, and we believe we are one of the leading world-wide suppliers of cytokine related products in the research market. We further believe that the expanding line of our products, their recognized quality, and the growing demand for protein related and chemically-based research reagents will allow us to remain competitive in the growing biotechnology research and diagnostic market.

Biotechnology Segment Manufacturing

Our Biotechnology segment develops and manufactures the majority of its cytokines using recombinant DNA technology, thus significantly reducing our reliance on outside resources. Tocris chemical-based products are synthesized from widely available products. We typically have several outside sources for all critical raw materials necessary for the manufacture of our products.

The majority of Bio-Techne’s biotechnology products are shipped within one day of receipt of the customers’ orders. Consequently, we had no significant backlog of orders for our Biotechnology segment products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2013.

3

Clinical Controls Segment

Proper diagnosis of many illnesses requires a thorough and accurate analysis of a patient’s blood cells, which is usually done with automated or semi-automated hematology instruments. Our Clinical Controls segment develops and manufactures controls and calibrators for instruments in the global clinical market.

Clinical Controls Segment Products

Hematology controls and calibrators are products derived from various cellular components of blood which have been stabilized. Control and calibrator products can be utilized to ensure that hematology instruments are performing accurately and reliably. Ordinarily, a hematology control is used once to several times a day to make sure the instrument is reading accurately. In addition, most instruments need to be calibrated periodically. Hematology calibrators are similar to controls, but undergo additional testing to ensure that the calibration values assigned are within tight specifications and can be used to calibrate the instrument.

Cell-based whole blood controls. Our Clinical Controls segment offers a wide range of hematology controls and calibrators for both impedance and laser type cell counters. Hematology control products are also supplied for use as proficiency testing tools by laboratory certifying authorities in a number of states and countries. We believe our products have improved stability and versatility and a longer shelf life than most of those of our competitors.

Chemistry-based blood controls. The acquisition of Bionostics early in fiscal 2014 expanded our product offerings in the Clinical Controls segment through their chemistry-based blood controls. Controls for blood glucose and blood gas devices are the largest portion of Bionostics’ business. Bionostics recently launched coagulation device control products which extend its product portfolio and allow it to enter an adjacent market segment in the controls business.

Clinical Controls Segment Customers and Distribution Methods

Original Equipment Manufacturer (OEM) agreements represent the largest market for our clinical controls products. In fiscal 2014, 2013 and 2012, OEM agreements accounted for $41.2 million, $10.8 million and $9.7 million, respectively, or 12%, 3% and 3% of total consolidated net sales in each fiscal year, respectively. The increase in fiscal 2014 was a result of the acquisition of Bionostics. We sell our clinical control products directly to customers in the United States and through distributors in the rest of the world. One OEM customer accounted for approximately 14% of Clinical Controls’ net sales during fiscal 2014. No single customer accounted for more than 10% of Clinical Controls’ net sales in fiscal 2013 or 2012.

Clinical Controls Segment Competitors

Competition is intense in the clinical controls business. The first control products were developed in response to the rapid advances in electronic instrumentation used in hospital and clinical laboratories for blood cell counting. Historically, most of the instrument manufacturing companies made controls for use on their own instruments. With rapid expansion of the instrument market, however, a need for more versatile controls enabled non-instrument manufacturers to gain a foothold. Today the market is composed of manufacturers of laboratory reagents, chemicals and coagulation products and independent blood control manufacturers in addition to instrument manufacturers. The principal clinical diagnostic control competitors for our products in this segment are Abbott Diagnostics, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Streck, Inc., Siemens Healthcare Diagnostics Inc. and Sysmex Corporation. We believe we are the third largest supplier of hematology controls in the marketplace behind Beckman Coulter, Inc. and Streck, Inc.

Clinical Controls Segment Manufacturing

The primary raw material for our clinical controls products is whole blood. Human blood is purchased from commercial blood banks, while porcine and bovine blood is purchased from nearby meat processing plants. After raw blood is received, it is separated into its components, processed and stabilized. Although the cost of human blood has increased due to the requirement that it be tested for certain diseases and pathogens prior to use, the higher cost of these materials has not had a material adverse effect on our business. Bio-Techne does not perform its own pathogen testing, as most suppliers test all human blood collected.

4

There was no significant backlog of orders for our Clinical Control products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2013. The majority of the Clinical Control products are shipped based on a preset, recurring schedule.

Geographic Information

Following is financial information relating to geographic areas (in thousands):

| Year Ended June 30, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| External sales |

||||||||||||

| United States |

$ | 190,359 | $ | 164,308 | $ | 172,310 | ||||||

| Europe |

97,157 | 88,297 | 90,142 | |||||||||

| China |

18,878 | 14,106 | 11,378 | |||||||||

| Other Asia |

32,704 | 28,608 | 25,988 | |||||||||

| Rest of world |

18,665 | 15,256 | 14,742 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total external sales |

$ | 357,763 | $ | 310,575 | $ | 314,560 | ||||||

|

|

|

|

|

|

|

|||||||

| As of June 30, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Long-lived assets |

||||||||||||

| United States |

$ | 109,790 | $ | 103,541 | $ | 87,968 | ||||||

| Europe |

8,340 | 7,129 | 7,528 | |||||||||

| China |

678 | 117 | 141 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total long-lived assets |

$ | 118,808 | $ | 110,787 | $ | 95,637 | ||||||

|

|

|

|

|

|

|

|||||||

Net sales are attributed to countries based on the location of the customer or distributor. Long-lived assets are comprised of land, buildings and improvements and equipment, net of accumulated depreciation and other assets. See the description of risks associated with the Company’s foreign subsidiaries in Item 1A of this Annual Report on Form 10-K.

PRODUCTS UNDER DEVELOPMENT

Bio-Techne is engaged in ongoing research and development in all of our major product lines: controls and calibrators and cytokines, antibodies, assays, small bioactive molecules and related biotechnology products. We believe that our future success depends, to a large extent, on our ability to keep pace with changing technologies and market needs.

In fiscal 2014, Bio-Techne introduced approximately 1,600 new biotechnology products to the life science market. All of these products are for research use only and therefore did not require FDA clearance. We are planning to release new proteins, antibodies, immunoassay products and small molecules in the coming year. We also expect to significantly expand our portfolio of products through acquisitions of existing businesses. However, there is no assurance that any of the products in the research and development phase can be successfully completed or, if completed, can be successfully introduced into the marketplace.

| Year Ended June 30, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Research expense (in thousands): |

||||||||||||

| Biotechnology |

$ | 29,189 | $ | 28,441 | $ | 27,112 | ||||||

| Clinical Controls |

1,756 | 816 | 800 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 30,945 | $ | 29,257 | $ | 27,912 | |||||||

|

|

|

|

|

|

|

|||||||

| Percent of net sales |

9 | % | 9 | % | 9 | % | ||||||

5

ACQUISITIONS AND INVESTMENTS

Fiscal 2015 Acquisitions

On July 31, 2014, Bio-Techne closed on the acquisition of all of the outstanding equity of ProteinSimple for approximately $300 million. The purchase price may be adjusted post-closing based on the final levels of cash and working capital of ProteinSimple at closing. Certain ProteinSimple stockholders are subject to non-compete and non-solicitation obligations for three years following the closing. ProteinSimple develops, markets and sells Western-blotting instruments, biologics and reagents. Western blotting remains one of the most frequently practiced life science techniques, and ProteinSimple’s tools allow researchers to perform this basic research technique with greater speed and efficiency. Automation of the Western blotting technique has the potential to drive additional sales of the consumables Bio-Techne already sells, especially antibodies which have been validated for Western blotting applications.

On July 2, 2014, Bio-Techne announced that it had acquired all of the issued and outstanding equity interests of Novus Biologicals, LLC (Novus) for approximately $60.0 million. Novus is a Littleton, Colorado-based supplier of a large portfolio of both outsourced and in-house developed antibodies and other reagents for life science research, delivered through an innovative digital commerce platform. The acquisition further expanded our antibody portfolio, consistent with our long term strategic business plan to serve customers with a complete and quality line of reagents.

Fiscal 2014 Investments and Acquisitions

On July 22, 2013, the Company’s R&D Systems subsidiary acquired for approximately $103 million cash all of the outstanding shares of Bionostics. Bionostics is a global leader in the development, manufacture and distribution of control solutions that verify the proper operation of in-vitro diagnostic devices primarily utilized in point of care blood glucose and blood gas testing. Bionostics is included in Bio-Techne’s Clinical Controls segment.

On April 30, 2014, Bio-Techne’s China affiliate, R&D Systems China, acquired PrimeGene for approximately $18.8 million. PrimeGene is a leader in the China market in the development and manufacture of recombinant proteins for research and industrial applications, and has large scale protein manufacturing capabilities to serve the Chinese market as well as global industrial customers. PrimeGene is included in Bio-Techne’s Biotechnology segment.

On April 1, 2014, Bio-Techne, through its wholly-owned subsidiary R&D Systems, Inc., entered into an agreement to invest $10.0 million in CyVek, Inc. in return for shares of CyVek common stock representing approximately 19.9% of the outstanding voting stock of CyVek. In connection with this investment, R&D Systems became a party to CyVek’s existing investor agreements and has an observer seat on CyVek’s board of directors. If, within 12 months of the date of the agreement, CyVek meets commercial milestones related to the sale of its CyPlex analyzer products, Bio-Techne will acquire all of the remaining stock of CyVek through a merger. If the merger is consummated, Bio-Techne will make an initial payment of $60.0 million to the other stockholders of CyVek. The purchase price payable at the closing may be adjusted based on the final levels of CyVek’s net working capital. We will also pay CyVek’s other stockholders up to $35.0 million based on the revenue generated by CyVek’s products and related products before the date that is 30 months from the closing of the merger. We will also pay CyVek’s other stockholders 50% of the amount, if any, by which the revenue from CyVek’s products and related products exceeds $100 million in calendar year 2020.

The combination of Bio-Techne’s reagents on CyVek’s multiplex testing platform, CyPlex™, will provide researchers with powerful tools to develop, validate and test biomarker panels so as to expedite life sciences research and enable biomarker-based diagnostics. This strategic investment will allow us to continue to have a strong market position in the immunoassay market where multiplex testing platforms are becoming more significant.

Fiscal 2013 and 2012 Acquisitions

We did not complete any material acquisitions or make any material strategic investments during fiscal 2013 and 2012.

6

Prior Investments

Bio-Techne has an approximate 14% equity investment in ChemoCentryx, Inc. (CCXI). CCXI is a technology and drug development company working in the area of chemokines. Chemokines are cytokines which regulate the trafficking patterns of leukocytes, the effector cells of the human immune system. Bio-Techne’s investment in CCXI is included in “Short-term available-for-sale investments” at June 30, 2014 and 2013 at fair values of $37.1 million and $89.6 million, respectively.

GOVERNMENT REGULATION

All manufacturers of clinical diagnostic controls are regulated under the Federal Food, Drug and Cosmetic Act, as amended. All of Bio-Techne’s clinical control products are classified as “in vitro diagnostic products” by the U.S. Food and Drug Administration (FDA). The entire control manufacturing process, from receipt of raw materials to the monitoring of control products through their expiration date, is strictly regulated and documented. FDA inspectors make periodic site inspections of Bio-Techne’s clinical control operations and facilities. Clinical control manufacturing must comply with Quality System Regulations (QSR) as set forth in the FDA’s regulations governing medical devices.

Three of Bio-Techne’s immunoassay kits, EPO, TfR and ß2M, have FDA clearance to be sold for clinical diagnostic use. Bio-Techne must comply with QSR for the manufacture of these kits. Biotechnology products manufactured in the U.S. and sold for use in the research market do not require FDA clearance. Tocris products are used as research tools and require no regulatory approval for commercialization. Some of Tocris’ products are considered controlled substances and require government permits to stock such products and to ship them to end-users. Bio-Techne has no reason to believe that these annual permits will not be re-issued.

Some of Bio-Techne’s research groups use small amounts of radioactive materials in the form of radioisotopes in their product development activities. Thus, Bio-Techne is subject to regulation and inspection by the Minnesota Department of Health and has been granted a license through August 2016. Bio-Techne has had no difficulties in renewing this license in prior years and has no reason to believe it will not be renewed in the future. If, however, the license was not renewed, it would have minimal effect on Bio-Techne’s business since there are other technologies the research groups could use to replace the use of radioisotopes.

Beginning on January 1, 2013, Bio-Techne is subject to the medical device excise tax which was included as part of the Affordable Care Act. The tax applies to the sale of medical devices by a manufacturer, producer or importer of the device and is 2.3% of the sale price. The tax applies to Bio-Techne’s in vitro diagnostic products, including its clinical control products and biotechnology clinical diagnostic immunoassay kits. Bio-Techne’s medical device excise tax for fiscal 2014 and 2013 was $0.5 million and $0.1 million, respectively.

PATENTS AND TRADEMARKS

Bio-Techne owns patent protection for certain clinical controls products which generally have a life of 20 years from the date of the patent application or patent grant. Bio-Techne is not substantially dependent on products for which it has obtained patent protection.

Bio-Techne may seek patent protection for new or existing products it manufactures. No assurance can be given that any such patent protection will be obtained. No assurance can be given that Bio-Techne’s products do not infringe upon patents or proprietary rights owned or claimed by others, particularly for genetically engineered products. Bio-Techne has not conducted a patent infringement study for each of its products.

Bio-Techne has a number of licensing agreements with patent holders under which it has the exclusive and/or non-exclusive right to use patented technology as well as the right to manufacture and sell certain patented proteins and related products to the research market. For fiscal 2014, 2013 and 2012, total royalties expensed under these licenses were approximately $3.5 million, $3.3 million and $3.2 million, respectively.

7

Bio-Techne has obtained federal trademark registration for certain of its brand names and clinical controls and biotechnology product groups which generally have a life of 10 years from the date of the trademark grant. Bio-Techne believes it has common law trademark rights to certain marks in addition to those which it has registered.

SEASONALITY OF BUSINESS

Biotechnology segment products marketed by Bio-Techne historically experience a slowing of sales or of the rate of sales growth during the summer months. Bio-Techne also usually experiences a slowing of sales in both of its reportable segments during the Thanksgiving to New Year holiday period. Bio-Techne believes this seasonality is a result of vacation and academic schedules of its world-wide customer base.

EMPLOYEES

Through its subsidiaries, Bio-Techne employed 967 full-time and 54 part-time employees as of June 30, 2014, as follows:

| Full- time |

Part- time |

|||||||

| U.S. |

782 | 25 | ||||||

| Europe |

107 | 29 | ||||||

| Asia |

78 | 0 | ||||||

|

|

|

|

|

|||||

| 967 | 54 | |||||||

|

|

|

|

|

|||||

ENVIRONMENT

Compliance with federal, state and local environmental protection laws in the United States, United Kingdom, Germany, China and Hong Kong had no material effect on Bio-Techne in fiscal 2014.

INVESTOR INFORMATION

We are subject to the information requirements of the Securities Exchange Act of 1934 (the Exchange Act). Therefore, we file periodic reports, proxy statements, and other information with the Securities and Exchange Commission (SEC). Such reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

Financial and other information about us is available on our web site (http://www.bio-techne.com). We make available on our web site copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

EXECUTIVE OFFICERS OF THE REGISTRANT

Currently, the names, ages, positions and periods of service of each executive officer of the Company are as follows:

| Name |

Age | Position |

Officer Since |

|||||||

| Charles Kummeth |

54 | President, Chief Executive Officer and Director | 2013 | |||||||

| James T. Hippel |

43 | Chief Financial Officer | 2014 | |||||||

| Brenda Furlow |

56 | Senior Vice President, General Counsel | 2014 | |||||||

| J. Fernando Bazan |

54 | Chief Technical Officer | 2013 | |||||||

| Marcel Veronneau |

60 | Senior Vice President, Clinical Controls | 1995 | |||||||

| Kevin Reagan |

62 | Senior Vice President, Biotech | 2013 | |||||||

| David Eansor |

53 | Senior Vice President, Novus Biologicals | 2014 | |||||||

8

Set forth below is information regarding the business experience of each executive officer. There are no family relationships among any of the officers named, nor is there any arrangement or understanding pursuant to which any person was selected as an officer.

Charles Kummeth has been President and Chief Executive Officer of the Company since April 1, 2013. Prior to joining the Company, he served as President of Mass Spectrometry and Chromatography at Thermo Fisher Scientific Inc. from September 2011. He was President of that company’s Laboratory Consumables Division from 2009 to September 2011. Prior to joining Thermo Fisher, Mr. Kummeth served in various roles at 3M Corporation, most recently as the Vice President of the company’s Medical Division from 2006 to 2008.

James T. Hippel has been Chief Financial Officer of the Company since April 1, 2014. Prior to joining the Company, Mr. Hippel served as Senior Vice President and Chief Financial Officer for Mirion Technologies, Inc., a $300 million global company that provides radiation detection and identification products. Prior to Mirion, Mr. Hippel served as Vice President, Finance at Thermo Fisher Scientific, Inc., leading finance operations for its Mass Spectrometry & Chromatography division and its Laboratory Consumables division. In addition, Mr. Hippel’s experience includes nine years of progressive financial leadership at Honeywell International, within its Aerospace Segment. Mr. Hippel started his career with KPMG LLP and is a CPA (inactive).

Brenda Furlow joined the Company as Senior Vice President and General Counsel on August 4, 2014. Most recently, Ms. Furlow was an associate with Alphatech Counsel, SC and served as general counsel to emerging growth technology companies. Ms. Furlow was General Counsel for TomoTherapy, Inc., a global, publicly traded company that manufactured and sold radiation therapy equipment from 2007 to 2011. From 1998 to 2007, Ms. Furlow served as General Counsel for Promega Corporation, a global life sciences company. In addition, Ms. Furlow’s experience includes five years in various positions with a credit union trade association. Ms. Furlow began her legal career as an associate with a Chicago-based law firm.

Dr. J. Fernando Bazan was appointed Chief Technical Officer when he joined the Company on August 1, 2013. Dr. Bazan is an adjunct profession at the University of Minnesota School of Medicine and served as Chief Scientific Officer at Neuroscience, Inc., a neuroimmunology startup from 2010 to 2012. From 2003 through 2010, Dr. Bazan served as Senior Scientist at Genentech, Inc. (Roche).

Marcel Veronneau was appointed as Vice President, Clinical Controls in March 1995. Prior thereto, he served as Director of Operations for R&D Systems’ Clinical Controls Division since joining the Company in 1993.

Dr. Kevin Reagan was appointed Senior Vice President, Biotech on August 1, 2013. Dr. Reagan joined the Company in January 2012 as R&D Systems’ Vice President of Immunology. Prior to joining the Company, Dr. Reagan served as Managing Director of Calbiotech Veterinary Diagnostics from 2010 through 2011 and Senior Vice President of Calbiotech, Inc from 2009 through 2011. From 2005 through 2009, he served as Vice President, R&D, Immunological Systems at Invitrogen, Corp, a division of Life Technologies Corporation.

David Eansor has served as Senior Vice President, Novus Biologicals, since the Company completed its acquisition of Novus on July 2, 2014. From January 2013 until the date of the acquisition, Mr. Eansor was the Senior Vice President of Corporate Development of Novus Biologicals. Prior to joining Novus, Mr. Eansor was the President of the Bioscience Division of Thermo Fisher Scientific. Mr. Eansor was promoted to Division President in early 2010 after 5 years as President of Thermo Fisher’s Life Science Research business.

9

Statements in this Annual Report on Form 10-K, and elsewhere, that are forward-looking involve risks and uncertainties which may affect the Company’s actual results of operations. Certain of these risks and uncertainties which have affected and, in the future, could affect the Company’s actual results are discussed below. The Company undertakes no obligation to update or revise any forward-looking statements made due to new information or future events. Investors are cautioned not to place undue emphasis on these statements.

The following risk factors should be read carefully in connection with evaluation of the Company’s business and any forward-looking statements made in this Annual Report on Form 10-K and elsewhere. Any of the following risks or others discussed in this Annual Report on Form 10-K or the Company’s other SEC filings could materially adversely affect the Company’s business, operating results and financial condition.

Changes in economic conditions could negatively impact the Company’s revenues and earnings.

The Company’s biotechnology products are sold primarily to research scientists at pharmaceutical and biotechnology companies and at university and government research institutions. Research and development spending by the Company’s customers and the availability of government research funding can fluctuate due to changes in available resources, mergers of pharmaceutical and biotechnology companies, spending priorities, general economic conditions and institutional and governmental budgetary policies. The U.S. and global economies have experienced a period of economic downturn. Such downturns, and other reductions or delays in governmental funding, could cause customers to delay or forego purchases of the Company’s products. The Company carries essentially no backlog of orders and changes in the level of orders received and filled daily can cause fluctuations in quarterly revenues and earnings.

The biotechnology and clinical control industries are very competitive, more so recently due to consolidation trends.

The Company faces significant competition across all of its product lines and in each market in which it operates. Competitors include companies ranging from start-up companies, which may be able to more quickly respond to customers’ needs, to large multinational companies, which may have greater financial, marketing, operational, and research and development resources than the Company. In addition, consolidation trends in the pharmaceutical and biotechnology industries have served to create fewer customer accounts and to concentrate purchasing decisions for some customers, resulting in increased pricing pressure on the Company. Moreover, customers may believe that consolidated businesses are better able to compete as sole source vendors, and therefore prefer to purchase from such businesses. The entry into the market by manufacturers in China and other low-cost manufacturing locations is also creating increased pricing and competitive pressures, particularly in developing markets. Failure to anticipate and respond to competitors’ actions may impact the Company’s future sales and earnings.

The Company’s future growth is dependent on the development of new products in a rapidly changing technological environment.

One element of the Company’s growth strategy is to increase revenues through new product releases. As a result, the Company must anticipate industry trends and develop products in advance of customer needs. New product development requires planning, designing and testing at both technological and manufacturing-process levels and may require significant research and development expenditures. There can be no assurance that any products now in development, or that the Company may seek to develop in the future, will achieve feasibility or gain market acceptance. There can also be no assurance that the Company’s competitors will not succeed in developing technologies and products in a more timely and cost effective manner than the Company. If the Company does not appropriately innovate and invest in new technologies, the Company’s technologies will become outdated, rendering the Company’s technologies and products obsolete or noncompetitive. To the extent the company fails to introduce new and innovative products, the Company may lose market share to its competitors, which may be difficult or impossible to regain.

10

Acquisitions and divestures pose financial, management and other risks and challenges.

The Company routinely explores acquiring other businesses and assets. From time to time, the Company may also consider disposing of certain assets, subsidiaries, or lines of business. In early fiscal 2014, the Company finalized the acquisition of Bionostics. In the last quarter of fiscal 2014, the Company acquired PrimeGene and announced its investment in CyVek and its intention to acquire the remaining shares of CyVek in the event certain milestones were met. Subsequent to the close of fiscal 2014, the Company also acquired Novus and ProteinSimple. Acquisitions or divestitures present financial, managerial and operational challenges, including diversion of management attention, difficulty with integrating acquired businesses, integration of different corporate cultures or separating personnel and financial and other systems, increased expenses, assumption of unknown liabilities, indemnities, and potential disputes with the buyers or sellers, and the need to evaluate the financial systems of and establish internal controls for acquired entities. There can be no assurance that the Company will engage in any acquisitions or divestitures or that the Company will be able to do so on terms that will result in any expected benefits. In addition, acquisitions financed with borrowings could make the Company more vulnerable to business downturns and could negatively affect the Company’s earnings due to higher leverage and interest expense.

The Company is subject to risk associated with global operations.

The Company engages in business globally, with approximately 47% of the Company’s sales revenue in fiscal 2014 coming from outside the U.S. This subjects the Company to a number of risks, including international economic, political, and labor conditions; tax laws (including U.S. taxes on foreign subsidiaries); increased financial accounting and reporting burdens and complexities; unexpected changes in, or impositions of, legislative or regulatory requirements; failure of laws to protect intellectual property rights adequately; inadequate local infrastructure and difficulties in managing and staffing international operations; delays resulting from difficulty in obtaining export licenses for certain technology; tariffs, quotas and other trade barriers and restrictions; transportation delays; operating in locations with a higher incidence of corruption and fraudulent business practices; and other factors beyond the Company’s control, including terrorism, war, natural disasters, climate change and diseases.

The application of laws and regulations implicating global transactions is often unclear and may at times conflict. Compliance with these laws and regulations may involve significant costs or require changes in the Company’s business practices that result in reduced revenue and profitability. Non-compliance could also result in fines, damages, criminal sanctions, prohibitions business conduct, and damage to the Company’s reputation. The Company incurs additional legal compliance costs associated with its global operations and could become subject to legal penalties in foreign countries if it does not comply with local laws and regulations, which may be substantially different from those in the U.S.

The Company conducts and plans to grow its business in developing markets.

The Company’s efforts to grow its businesses depends, to a degree, on its success in developing market share in additional geographic markets including, but not limited to, China. In some cases, these countries have greater political and economic volatility and greater vulnerability to infrastructure and labor disruptions than the Company’s other markets. Operating and seeking to expand business in a number of different regions and countries exposes the Company to multiple and potentially conflicting cultural practices, business practices and legal and regulatory requirements.

In many foreign countries, particularly in those with developing economies, it may be common to engage in business practices that are prohibited by U.S. regulations applicable to the Company, such as the Foreign Corrupt Practices Act. Although the Company implements policies and procedures designed to ensure compliance with these laws, there can be no assurance that all of the Company’s employees, contractors, and agents, as well as those companies to which the Company outsources certain aspects of its business operations, including those based in foreign countries where practices which violate such U.S. laws may be customary, will comply with the Company’s internal policies. Any such non-compliance, even if prohibited by the Company’s internal policies, could have an adverse effect on the Company’s business and result in significant fines or penalties.

11

The Company is significantly dependent on sales made through foreign subsidiaries which are subject to changes in exchange rates and changes to the strength of foreign governments and economic conditions.

Approximately 30% of the Company’s net sales in fiscal 2014 were made through its foreign subsidiaries, which transact their sales in foreign currencies. Any adverse movement in foreign currency exchange rates could, therefore, negatively affect the Company’s revenues and earnings. Moreover, the financial crisis faced by several Eurozone countries, and the ongoing economic instability in that region, may lead to reduced spending on health care and research by Eurozone governments, which could adversely affect the Company’s European sales, as well as its revenues, financial condition and results of operations.

The Company may incur losses as a result of its investments in ChemoCentryx, Inc., CyVek, Inc. and other companies in which is does not have a majority interest, the success of which is largely out of the Company’s control.

The Company’s expansion strategies include collaborations and investments in joint ventures and companies developing new products related to the Company’s business. These strategies carry risks that objectives will not be achieved and future earnings will be adversely affected.

The Company has an approximate 14% equity investment in ChemoCentryx, Inc. (CCXI) that is valued at $37.1 million on the Company’s June 30, 2014 Consolidated Balance Sheet. CCXI is a biopharmaceutical company focused on discovering, developing and commercializing orally-administered therapeutics to treat autoimmune diseases, inflammatory diseases and cancers. The development of new drugs is a highly risky undertaking. CCXI is dependent on a limited number of products, must achieve favorable clinical trial results, obtain regulatory and marketing approval for these products and is reliant on a strategic alliance with GlaxoSmithKline. CCXI has also incurred significant losses and has yet to achieve profitability.

The ownership of CCXI shares is very concentrated, the share price is highly volatile and there is limited trading of the shares. These factors make it possible that the Company could experience future dilution or a decline in the $7.6 million unrealized gain it has on its CCXI investment and/or its original $29.5 million investment in CCXI. At August 22, 2014, the market value of the Company’s investment in CCXI was $30.9 million.

On April 1, 2014, the Company invested $10 million in CyVek, Inc. in exchange for shares of CyVek’s common stock representing approximately 19.9% of the outstanding voting stock of CyVek. In connection with this investment, the Company also became a party to CyVek’s existing investor agreements and has an observer seat on CyVek’s board of directors. CyVek is an instrument company that has developed a microfluidics instrument platform and related reagents for performing immunoassays and other assays for the research market. Cyvek has incurred significant losses and has not yet achieved profitability. There is no assurance that the Company’s investment in CyVek will bring sufficient returns, and may in fact result in losses.

The Company’s success will be dependent on recruiting and retaining highly qualified personnel.

Recruiting and retaining qualified scientific, production and management personnel are critical to the Company’s success. The Company’s anticipated growth and its expected expansion into areas and activities requiring additional expertise will require the addition of new personnel and the development of additional expertise by existing personnel. The failure to attract and retain such personnel could adversely affect the Company’s business.

The Company is dependent on maintaining its intellectual property rights.

The Company’s success depends in part on its ability to protect and maintain its intellectual property, including trade secrets. The Company attempts to protect trade secrets in part through confidentiality agreements, but those agreements can be breached, and if they are, there may not be an adequate remedy. If trade secrets become publicly known, the Company could lose its competitive position.

12

In addition, the Company’s success depends in part on its ability to operate without infringing the proprietary rights of others, and to obtain licenses where necessary or appropriate. The Company has obtained and continues to negotiate licenses to produce a number of products claimed to be owned by others. Since the Company has not conducted a patent infringement study for each of its products, it is possible that products of the Company may unintentionally infringe patents of third parties.

The Company has been and may in the future be sued by third parties alleging that the Company is infringing their intellectual property rights. These lawsuits are expensive, take significant time, and divert management’s focus from other business concerns. If the Company is found to be infringing the intellectual property of others, it could be required to cease certain activities, alter its products or processes or pay licensing fees. This would cause unexpected costs and delays which may have a material adverse effect on the Company. If the Company is unable to obtain a required license on acceptable terms, or unable to design around any third party patent, it may be unable to sell some of its products and services, which could result in reduced revenue. In addition, if the Company does not prevail, a court may find damages or award other remedies in favor of the opposing party in any of these suits, which may adversely affect the Company’s earnings.

The Company has entered into and drawn on a revolving credit facility. The burden of this additional debt could adversely affect the Company, make it more vulnerable to adverse economic or industry conditions, and prevent it from funding its expansion strategy.

In connection with the acquisition of ProteinSimple in July 2014, the Company entered into a revolving credit facility, governed by a Credit Agreement dated July 28, 2014. The Credit Agreement provides for a revolving credit facility of $150 million, which can be increased by an additional $150 million subject to certain conditions. Borrowings under the Credit Agreement bear interest at a variable rate. As of July 31, 2014, the Company had drawn $125 million under the Credit Agreement.

The terms of the Credit Agreement and the burden of the indebtedness incurred thereunder could have negative consequences for us, such as:

| • | limiting our ability to obtain additional financing to fund our working capital, capital expenditures, debt service requirements, expansion strategy, or other needs; |

| • | increasing the Company’s vulnerability to, and reducing its flexibility in planning for, adverse changes in economic, industry and competitive conditions; and |

| • | increasing the Company’s vulnerability to increases in interest rates. |

The Credit Agreement also contains negative covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability to, among other things, sell, lease or transfer any properties or assets, with certain exceptions; and enter into certain merger, consolidation or other reorganization transactions, with certain exceptions.

A breach of any of these covenants could result in an event of default under our credit facility. Upon the occurrence of an event of default, the lender could elect to declare all amounts outstanding under such facility to be immediately due and payable and terminate all commitments to extend further credit. In addition, the Company would be subject to additional restrictions if an event of default exists under the Credit Agreement, such as a prohibition on the payment of cash dividends.

13

The Company’s business is subject to governmental laws and regulations.

The Company’s operations are subject to regulation by various US federal, state and international agencies. Laws and regulations enacted and enforced by these agencies impact all aspects of the Company’s operations including design, development, manufacturing, labeling, selling and the importing and exporting of products across international borders. Any changes to laws and regulations governing such activities could have an effect on the Company’s operations and ability to obtain regulatory clearance or approval of the Company’s products. If the Company fails to comply with any of these regulations, it may become subject to fines, penalties or actions that could impact development, manufacturing and distribution and/or increase costs or reduce sales. The approval process applicable to clinical control products of the type that may be developed by the Company may take a year or more. Delays in obtaining approvals could adversely affect the marketing of new products developed by the Company, and negatively affect the Company’s revenues.

As a multinational corporation, the Company is subject to the tax laws and regulations of U.S. federal, state and local governments and of several international jurisdictions. From time to time, new tax legislation may be implemented which could adversely affect current or future tax filings or negatively impact the Company’s effective tax rate and thus increase future tax payments.

The Company relies heavily on internal manufacturing and related operations to produce, package and distribute its products.

The Company manufactures the majority of the products it sells at its Minneapolis, Minnesota facility. Quality control, packaging and distribution operations support all of the Company’s sales. Since the Company creates value for its customers through the development of high-quality products, any significant decline in quality or disruption of operations for any reason, particularly at the Minneapolis facility, could adversely affect sales and customer relationships, and therefore adversely affect the business. While the Company has taken certain steps to manage these operational risks, and while insurance coverage may reimburse, in whole or in part, for losses related to such disruptions, the Company’s future sales growth and earnings may be adversely affected by perceived disruption risks or actual disruptions.

The design and manufacture of products involves certain inherent risks. Manufacturing or design defects could lead to recalls, litigation or alerts relating to the Company’s products. A recall could result in significant costs and damage to the Company’s reputation which could reduce demand, particularly for certain of its regulated products.

Disruptions in the supply and cost of raw materials could reduce the Company’s earnings, cash flow, and ability to meet customers’ needs.

The Company’s products are made from a wide variety of raw materials that are generally available from alternate sources of supply. However, some of the Company’s products are available only from a single supplier. If such suppliers were to limit or terminate production or otherwise fail to supply these materials for any reason, such failures could have a material adverse impact on the Company’s product sales and business. In addition, price increases for raw materials could adversely affect the Company’s earnings and cash flow.

Increased exposure to product liability claims could adversely affect the Company’s earnings.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products offered by the Company’s customers. Currently these risks are primarily borne by the Company’s customers. As the Company’s products and services are further integrated into customers’ production processes, the Company may become increasingly exposed to product liability and other claims in the event that the use of its products or services is alleged to have resulted in adverse effects. There can be no assurance that a future product liability claim or series of claims brought against the Company would not have an adverse effect on the Company’s business or the results of operations. The Company’s business may be materially and adversely affected by a successful product liability claim or claims in excess of any insurance coverage that it may have. In addition, product liability claims, regardless of their merits, could be costly, divert management’s attention, and adversely affect the Company’s reputation and demand for its products.

14

Any such product liability claims brought against the Company could be significant and any adverse determination may result in liabilities in excess of the Company’s insurance coverage. Although the Company carries product liability insurance, it cannot be certain that current insurance will be sufficient to cover these claims or that it can be maintained on acceptable terms, if at all.

Cyber security risks and the failure to maintain the confidentiality, integrity, and availability of the Company’s computer hardware, software, and Internet applications and related tools and functions could result in damage to the Company’s reputation and/or subject the Company to costs, fines, or lawsuits.

The integrity and protection of the Company’s own data, and that of its customers and employees, is critical to the Company’s business. The regulatory environment governing information, security and privacy laws is increasingly demanding and continues to evolve. Maintaining compliance with applicable security and privacy regulations may increase the Company’s operating costs and/or adversely impact the Company’s ability to market its products and services to customers. Although the Company’s computer and communications hardware is protected through physical and software safeguards, it is still vulnerable to fire, storm, flood, power loss, earthquakes, telecommunications failures, physical or software break-ins, software viruses, and similar events. These events could lead to the unauthorized access, disclosure and use of non-public information. The techniques used by criminal elements to attack computer systems are sophisticated, change frequently and may originate from less regulated and remote areas of the world. As a result, the Company may not be able to address these techniques proactively or implement adequate preventative measures. If the Company’s computer systems are compromised, it could be subject to fines, damages, litigation, and enforcement actions, customers could curtail or cease using its applications, and the Company could lose trade secrets, the occurrence of which could harm its business.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments as of the date of this report.

The Company owns the facilities that its headquarters and R&D Systems subsidiary occupy in Minneapolis, Minnesota. The Minneapolis facilities are utilized by both the Company’s Clinical Controls and Biotechnology segments.

The Minneapolis complex includes approximately 800,000 square feet of space in several adjoining buildings. Bio-Techne uses approximately 625,000 square feet of the complex for administrative, research, manufacturing, shipping and warehousing activities. The Company is currently leasing or plans to lease the remaining space in the complex as retail and office space.

The Company owns approximately 649 acres of farmland, including buildings, in southeast Minnesota. A portion of the land and buildings are leased to third parties as cropland and for a dairy operation. The remaining property is used by the Company to house animals for polyclonal antibody production for its Biotechnology segment.

Rental income from the above properties was $1.0 million, $0.8 million and $0.7 million in fiscal 2014, 2013 and 2012, respectively.

The Company owns the 17,000 square foot facility that its R&D Europe subsidiary occupies in Abingdon, England. This facility is utilized by the Company’s Biotechnology segment.

15

The Company leases the following facilities, all of which are utilized by the Company’s Biotechnology segment with the exception of the location used by the Company’s Bionostics subsidiary (Clinical Control segment):

| Subsidiary |

Location |

Type |

Square Feet |

|||||

| R&D Europe |

Langely, U.K. | Warehouse | 14,300 | |||||

| R&D GmbH |

Wiesbaden-Nordenstadt, Germany | Office space | 4,200 | |||||

| BiosPacific |

Emeryville, California | Office space | 3,000 | |||||

| R&D China |

Shanghai and Bejing, China | Office/warehouse | 8,200 | |||||

| R&D Hong Kong |

Hong Kong | Office space | 1,200 | |||||

| Boston Biochem |

Cambridge, Massachusetts | Office/lab | 7,400 | |||||

| Tocris |

Bristol, United Kingdom | Office/manufacturing/lab/warehouse | 11,000 | |||||

| PrimeGene |

Shanghai, China | Office/manufacturing/lab | 13,700 | |||||

| Bionostics |

Devens, Massachusetts | Office/manufacturing | 48,000 | |||||

The Company is currently pursuing new lease space for its Tocris operations. The Company believes the owned and leased properties, other than the Tocris facility, are adequate to meet its occupancy needs in the foreseeable future.

As of August 22, 2014, the Company is not a party to any legal proceedings that, individually or in the aggregate, are reasonably expected to have a material adverse effect on the Company’s business, results of operations, financial condition or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price of Common Stock

The Company’s common stock trades on the NASDAQ Global Select Market under the symbol “TECH.” The following table sets forth for the periods indicated the high and low sales price per share for the Company’s common stock as reported by the NASDAQ Global Select Market.

| Fiscal 2014 Price | Fiscal 2013 Price | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| 1st Quarter |

$ | 83.83 | $ | 69.30 | $ | 76.02 | $ | 66.26 | ||||||||

| 2nd Quarter |

94.78 | 77.14 | 74.17 | 65.37 | ||||||||||||

| 3rd Quarter |

96.96 | 82.51 | 72.20 | 65.67 | ||||||||||||

| 4th Quarter |

93.06 | 82.63 | 70.00 | 62.55 | ||||||||||||

16

Holders of Common Stock and Dividends Paid

As of August 22, 2014, there were over 31,000 beneficial shareholders of the Company’s common stock and over 150 shareholders of record. The Company paid quarterly cash dividends totaling $45.4 million, $43.5 million and $41.0 million in fiscal 2014, 2013 and 2012, respectively. The Board of Directors periodically considers the payment of cash dividends, and there is no guarantee that the Company will pay comparable cash dividends, or any cash dividends, in the future. The Company entered into a revolving line of credit in July 2014, which would prohibit payment of dividends to Company shareholders in the event of a default thereunder. The Credit Agreement that governs the revolving line of credit contains customary events of default.

Issuer Purchases of Equity Securities

There was no share repurchase activity by the Company in fiscal 2014. The maximum approximate dollar value of shares that may yet be purchased under the Company’s existing stock repurchase plan is approximately $125 million. The plan does not have an expiration date.

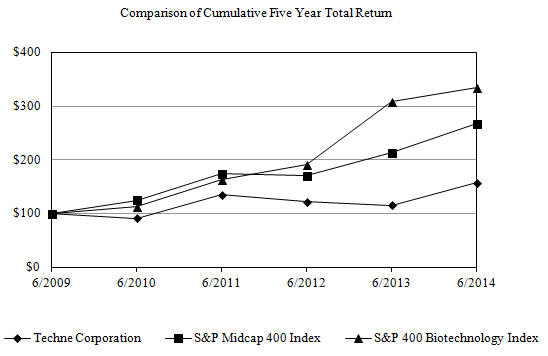

Stock Performance Graph

The following chart compares the cumulative total shareholder return on the Company’s common stock with the S&P Midcap 400 Index and the S&P 400 Biotechnology Index. The comparison assumes $100 was invested on the last trading day before July 1, 2009 in the Company’s common stock and in each of the foregoing indices and assumes reinvestment of dividends.

17

ITEM 6. SELECTED FINANCIAL DATA

(dollars in thousands, except per share data)

| Income and Share Data: |

2014 (1) | 2013 | 2012 | 2011 (2) | 2010 | |||||||||||||||

| Net sales |

$ | 357,763 | $ | 310,575 | $ | 314,560 | $ | 289,962 | $ | 269,047 | ||||||||||

| Operating income |

159,750 | 158,469 | 166,209 | 163,055 | 156,328 | |||||||||||||||

| Earnings before income taxes (3) |

161,392 | 160,662 | 162,195 | 164,981 | 156,446 | |||||||||||||||

| Net earnings |

110,948 | 112,561 | 112,331 | 112,302 | 109,776 | |||||||||||||||

| Diluted earnings per share |

3.00 | 3.05 | 3.04 | 3.02 | 2.94 | |||||||||||||||

| Average common and common equivalent shares – diluted (in thousands) |

37,005 | 36,900 | 37,006 | 37,172 | 37,347 | |||||||||||||||

| Balance Sheet Data as of June 30: |

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| Cash, cash equivalents and short-term available-for-sale investments |

$ | 363,354 | $ | 332,937 | $ | 268,986 | $ | 140,813 | $ | 138,811 | ||||||||||

| Working capital |

443,022 | 377,432 | 310,757 | 212,229 | 184,016 | |||||||||||||||

| Total assets |

862,491 | 778,098 | 719,324 | 617,670 | 518,816 | |||||||||||||||

| Total shareholders’ equity |

795,265 | 737,541 | 674,442 | 586,122 | 501,792 | |||||||||||||||

| Cash Flow Data: |

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| Net cash provided by operating activities |

$ | 136,762 | $ | 123,562 | $ | 126,746 | $ | 127,194 | $ | 111,260 | ||||||||||

| Capital expenditures |

13,821 | 22,454 | 6,017 | 3,630 | 4,644 | |||||||||||||||

| Cash dividends declared per share |

1.23 | 1.18 | 1.11 | 1.07 | 1.03 | |||||||||||||||

| Employee Data as of June 30: |

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| Full-time employees |

967 | 789 | 783 | 763 | 684 | |||||||||||||||

| (1) | The Company acquired Bionostics Holdings, Ltd on July 22, 2013 and Shanghai PrimeGene Bio-Tech Co. on April 30, 2014. |

| (2) | The Company acquired Boston Biochem, Inc. on April 1, 2011 and Tocris Holdings Limited and subsidiaries on April 28, 2011. |

| (3) | Earnings before income taxes included acquisition related expenses related to amortization of intangibles, costs recognized on sale of acquired inventories and professional fees associated with acquisition activity, as follows: 2014 – $20.0 million; 2013 – $10.2 million; 2012 – $12.7 million; 2011 – $5.0 million; 2010 – $1.0 million. |

18

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING INFORMATION

This report contains forward-looking statements, which are based on the Company’s current assumptions and expectations. The principal forward-looking statements in this report include: the Company’s expectations regarding product releases and strategy, acquisition activity, governmental license renewals, capital expenditures, the performance of the Company’s investments, future dividend declarations, the construction and lease of certain facilities, the adequacy of owned and leased property for future operations, anticipated financial results and sufficiency of capital resources to meet the Company’s foreseeable future cash and working capital requirements.

All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Although the Company believes there is a reasonable basis for the forward-looking statements, the Company’s actual results could be materially different. The most important factors which could cause the Company’s actual results to differ from forward-looking statements are set forth in the Company’s description of risk factors in Item 1A to this Annual Report on Form 10-K.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statements.

USE OF ADJUSTED FINANCIAL MEASURES

The adjusted financial measures used in this Annual Report on Form 10-K quantify the impact the following events had on reported net sales, gross margin percentages and net earnings for fiscal 2014 as compared to fiscal 2013 and 2012:

| • | fluctuations in exchange rates used to convert transactions in foreign currencies (primarily the Euro, British pound sterling and Chinese yuan) to U.S. dollars; |

| • | the acquisition of Bionostics Holdings, Ltd. (Bionostics) on July 22, 2013 and Shanghai PrimeGene Bio-Tech Co. (PrimeGene) on April 30, 2014, including the impact of amortizing intangible assets and the recognition of costs upon the sale of inventory written-up to fair value; |

| • | professional fees and other costs incurred as part of the acquisition of Bionostics and PrimeGene in fiscal 2014, the acquisitions of Novus Biologicals LLC (Novus) and ProteinSimple, which closed in July 2014, and on-going acquisition activity; |

| • | income tax adjustments related to the reinstatement of the U.S. credit for research and development expenditures in fiscal 2013, the expiration of the credit on December 31, 2013, and the reversal of valuation allowances on deferred tax assets in fiscal 2012; and |

| • | impairment losses related to the Company’s investments in unconsolidated entities. |

These adjusted financial measures are not prepared in accordance with generally accepted accounting principles (GAAP) and may be different from adjusted financial measures used by other companies. Adjusted financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The Company views these adjusted financial measures to be helpful in assessing the Company’s ongoing operating results. In addition, these adjusted financial measures facilitate our internal comparisons to historical operating results and comparisons to competitors’ operating results. These adjusted financial measures are included in this Annual Report on Form 10-K because the Company believes they are useful to investors in allowing for greater transparency related to supplemental information used in the Company’s financial and operational analysis. Investors are encouraged to review the reconciliations of adjusted financial measures used in this Annual Report on Form 10-K to their most directly comparable GAAP financial measures.

19

OVERVIEW

Bio-Techne develops, manufactures and sells biotechnology products and clinical diagnostic controls worldwide. With our deep product portfolio and application expertise, Bio-Techne is a leader in providing specialized proteins, including cytokines and growth factors, and related immunoassays, small molecules and other reagents to the research, diagnostics and clinical controls markets.

Bio-Techne operates worldwide and has two reportable business segments, Biotechnology and Clinical Controls, both of which service the life science and diagnostic markets. The Biotechnology reporting segment develops, manufactures and sells biotechnology research and diagnostic products world-wide. The Clinical Controls reporting segment develops and manufactures controls and calibrators for the global clinical market.

OVERALL RESULTS

For fiscal 2014, consolidated net sales increased 15% as compared to fiscal 2013. After adjusting for the impact of the Bionostics and PrimeGene acquisitions in fiscal 2014, as well as foreign currency fluctuations, organic sales for the year increased 3%. The growth was broad-based, with the Company achieving organic growth in both reporting segments and in most regions of the world. Commercial investments made globally in fiscal 2014, especially in China, were the biggest contributing factor impacting organic revenue growth.