UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

BIO-TECHNE CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Where

Science

Intersects

Innovation™

At Bio-Techne, we are accelerating discoveries to positively impact health; it drives us to collaborate, develop, and manufacture award-winning tools that help researchers achieve reproducible and consistent results. Whether customers are at the cutting-edge of academic research, translating basic discoveries to therapeutic leads, or at facilities that require the highest level of diagnostic testing, our innovative products and services provide the solutions scientists need to achieve success.

Message from our CEO

President and Chief Executive Officer

September 14, 2022

17% organic growth |

|

$211M capital returned to |

“We are focused on creating value for all our stakeholders, including our customers, employees, shareholders, and the communities where we live and work.”

Dear Fellow Shareholders:

The Bio-Techne team had a tremendous finish to fiscal 2022. We not only achieved record financial performance on multiple metrics; we also made significant progress strengthening our global team to position the Company to execute our global growth strategy going forward. We achieved these results with a commitment to growing our Company in a responsible manner while leveraging our deep scientific capabilities to deliver the products necessary to enable discoveries that ultimately improve global healthcare. I am extremely proud of our accomplishments this fiscal year.

From a financial perspective, we continued the momentum we experienced in fiscal 2021. We achieved 17% organic growth for the year and our revenue exceeded $1 billion for the first time in our corporate history. We delivered these results with a focus on profitable growth, achieving an adjusted operating margin of 38.3% for the fiscal year. GAAP earnings per diluted share were $6.63 for the fiscal year, while adjusted EPS increased 17% over the prior year to $7.89 per diluted share. We also returned $211 million in capital to our shareholders through $50 million in dividends and $161 million in share buybacks.

During fiscal 2022 we also continued to execute our M&A strategy. First, we strengthened our cell and gene therapy initiatives with an agreement for the future acquisition of Wilson Wolf, the manufacturer of the industry-leading line of G-Rex bioreactor devices that are used to scale cell therapies. Next, we announced the acquisition of Namocell, a leading provider of fast and easy use single cell sorting and dispensing platforms. Namocell, and eventually Wilson Wolf, strengthen Bio-Techne’s cell and gene therapy workflow solution, positioning the Company to be a dominant player in this emerging class of therapeutics.

We also made significant advancements on our Environmental, Social and Governance (ESG) initiatives in the past year. This fall, we will be publishing an updated Corporate Sustainability Report highlighting our numerous accomplishments on this front. For example, due to progress on our employee initiatives, Bio-Techne was included on the Forbes 2022 list of America’s Best Employers and the Forbes 2022 list of Best Employers for Diversity. Additionally, for the first time, our Corporate Sustainability Report will include an inventory of our Scope I and Scope II greenhouse gas (GHG) emissions data for our largest U.S.- and European-based manufacturing facilities.

We are focused on creating value for all our stakeholders, including our customers, employees, shareholders, and the communities where we live and work. We appreciate your vote supporting the proposals included in this proxy.

Thank you for your investment in Bio-Techne.

Sincerely,

Charles (“Chuck”) R. Kummeth

Thursday, October 27, 2022

8:00 a.m. Central Time

VIA WEBCAST

www.virtualshareholdermeeting.com/TECH2022

Items of Business:

| 1. | Set the number of members of the Board of Directors at nine; |

| 2. | Elect the Company’s nine nominees to the Board of Directors; |

| 3. | Approve, on an advisory basis, the compensation of our executive officers; |

| 4. | Approve an amendment to the Company’s Articles of Incorporation to increase the total number of authorized shares of common stock to effect a proposed four-for-one share split; and |

| 5. | Ratify the appointment of KPMG, LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year. |

By order of the Board of Directors

Brenda S. Furlow

Executive Vice President, General Counsel

and Corporate Secretary

September 14, 2022

Notice of 2022 Annual Meeting of Shareholders

We are pleased to offer the Annual Meeting as a webcast so that all our shareholders, regardless of their location, can participate. You can join the Annual Meeting online, vote your shares electronically, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/TECH2022. We will cover the items of business described in this Proxy Statement and provide time for questions. For more information, go to “Information About the Annual Meeting,” which begins on page 62 of this Proxy Statement.

Only shareholders of record at the close of business on September 2, 2022, will be entitled to attend and to vote at the Annual Meeting or any adjournment thereof. We hope you will join the webcast of Bio-Techne’s Annual Meeting. Whether or not you plan to attend, please make sure your shares are counted by providing your proxy as soon as possible.

Our 2022 Annual Report, which is not part of the proxy soliciting materials, is enclosed if the proxy materials were mailed to you. In addition, you can access the Annual Report at www.proxyvote.com.

Your vote is important

We encourage you to read the Proxy Statement and vote your shares as soon as possible. You may vote via the Internet at www.proxyvote.com or by telephone at 1-800-690-6903. If you received paper copies of your proxy materials in the mail, you may vote by mail using the return envelope enclosed for your convenience. The Proxy Statement and 2022 Annual Report to Shareholders are available at www.proxyvote.com.

How to Vote:

Even if you plan to attend the Annual Meeting, we encourage you to provide your proxy as soon as possible using one of the methods shown below.

|

BY INTERNET Visit www.proxyvote.com.

|

BY TELEPHONE In the U.S. or Canada, call

|

BY MAIL Mark, date, and sign your proxy card or voting instruction form and return it in the postage-paid envelope.

|

| Attending the Meeting | |||

| If you wish to attend the Annual Meeting via the webcast, you will need to register in advance using the 16-digit control number included in your proxy materials. Please see “Information About the Annual Meeting” beginning on page 62 of this Proxy Statement for further details. | |||

| 2022

Proxy Statement 3

| 2022

Proxy Statement 3

This section highlights selected information contained in this Proxy Statement. Please read the full Proxy Statement carefully before voting.

2022 Annual Meeting of Shareholders

|

|

|

Date and Time

October 27, 2022

8:00 a.m. (Central Time) |

Place

Webcast at |

Record Date

September 2, 2022 |

| Voting | Holders of Bio-Techne common stock are entitled to vote online at www.proxyvote.com, by telephone at 1-800-690-6903, by completing and returning a proxy card, or at the Annual Meeting. For more information, see “Information About the Annual Meeting.” |

Our Board of Directors is asking you to take the following actions at the Annual Shareholder Meeting:

| Item | Your

Board’s Recommendation |

Page | ||||

| 1. | Set the number of members of the Board of Directors at nine |

FOR |

11 | |||

| 2. | Elect the nine individuals nominated to be directors of the Company |

FOR |

11 | |||

| 3. | Approve, on an advisory basis, the compensation of our executive officers |

FOR |

52 | |||

| 4. | Approve an amendment to the Company’s Articles of Incorporation to increase the total number of authorized shares of common stock to effect a proposed four-for-one share split |

FOR |

55 | |||

| 5. | Ratify the appointment of KPMG, LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year |

FOR |

57 | |||

What’s

New?

What’s

New?

Our long-time President and CEO, Chuck Kummeth, has announced that he plans to retire June 30, 2024. The Board will be using this transition time to conduct a search for potential successors from both internal and external candidates.

We continued our sustainability journey with new ESG initiatives and substantially enhanced ESG disclosures, as reflected below and in our 2022 Corporate Sustainability Report, which will be published this Fall.

We expanded employee participation in our annual bonus and equity grant programs.

As a result of our commitment to and investment in our people, Bio-Techne was included on the Forbes 2022 lists of America’s Best Mid-Size Employers and Best Employers for Diversity.

We recently significantly increased the share ownership requirements for the directors and executive officers.

We rewrote, reorganized, and redesigned this document to help you better understand our governance and compensation practices and to demonstrate our commitment to transparency.

| 2022

Proxy Statement 4

| 2022

Proxy Statement 4

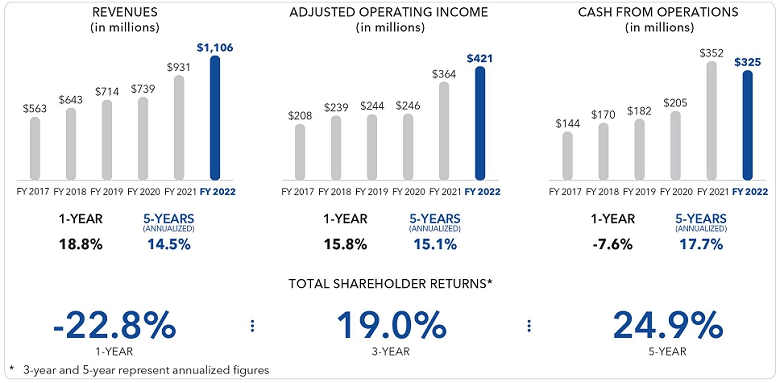

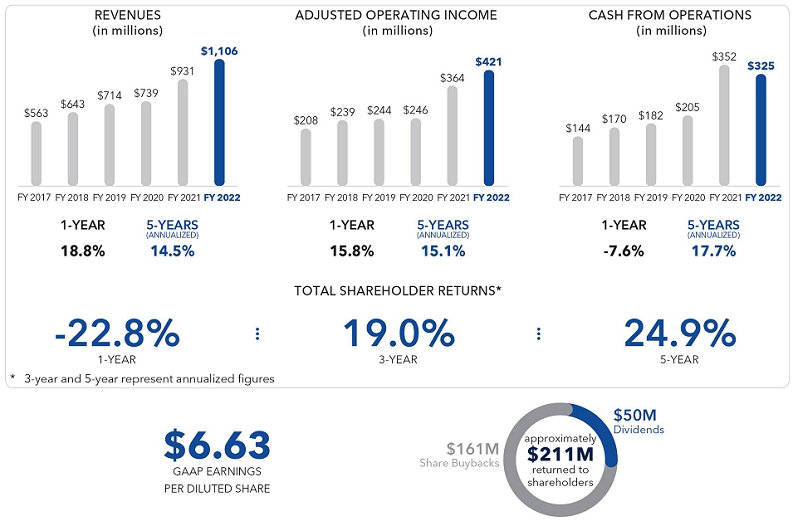

Fiscal Year 2022 Performance

Our team continued to deliver on our long-term strategy in fiscal year 2022, leading to another year of strong financial results.

| HIGHLIGHTS OF OUR FISCAL YEAR 2022 BUSINESS AND FINANCIAL PERFORMANCE INCLUDE: |

| We experienced a continuation of strong growth trends, driven by robust demand from our biopharma customers for our proteomic reagents, analytical tools, and cell and gene therapy workflow solutions. We also benefitted from increased traction with our ExoDx Prostate test due to improving physician office traffic, combined with our traditional and digital marketing initiatives. |

| Net sales for the full year fiscal 2022 increased 19% to $1,105.6 million. Organic growth was 17%, with acquisitions having a favorable impact of 3% and foreign currency translation having an unfavorable impact of 1%. |

| We furthered our cell and gene therapy initiatives through an agreement for the future acquisition of Wilson Wolf, the manufacturer of the industry-leading line of G-Rex bioreactor devices that are used to scale cell therapies. Terms of the agreement include a 20% investment when Wilson Wolf achieves trailing twelve-month (TTM) revenue of $92 million or TTM EBITDA of $55 million, at any point prior to December 31, 2027. If achieved, the second part of the forward contract will automatically trigger and requires the Company to acquire the remaining equity interest in Wilson Wolf on December 31, 2027 based on a revenue multiple of approximately 4.4 times revenue. The second part of the contract would be accelerated in advance of December 31, 2027 if Wilson Wolf meets its second milestone of approximately $226 million in TTM revenue or $136 million in TTM EBITDA. |

| We announced the acquisition of Namocell, a leading cell sorting and dispensing company with two instruments currently commercialized. Namocell’s proprietary instruments and consumables address several high-growth markets, including cell and gene therapy, cell engineering, cell line development, single cell genomics, antibody discovery, synthetic biology, and rare cell isolation. This acquisition closed at the beginning of our fiscal year 2023. |

| We commercialized five initial Good Manufacturing Practice (GMP) proteins manufactured in our 61,000-square foot, state-of-the-art GMP-compliant manufacturing facility in St. Paul, Minnesota at the scale and capacity necessary to meet current and forecasted demand. GMP proteins are an essential component for many immune-oncology and regenerative medicine cell and gene-modified therapy workflows. |

| We signed an exclusive agreement with Thermo Fisher Scientific to complete the development and commercialization of the ExoTRU kidney transplant rejection test developed by Exosome Diagnostics, a Bio-Techne brand. |

| GAAP net earnings were $272 million, while net earnings (adjusted) were $323.5 million. GAAP earnings per share were $6.63 per diluted share versus $3.47 per diluted share last fiscal year. GAAP EPS was favorably impacted by a non-operating mark-to-market gain of $16 million on our ChemoCentryx investment, compared to a loss on investment of $68 million in the prior fiscal year. Adjusted EPS was $7.89 per diluted share, compared to $6.76 in fiscal year 2021, representing an increase of 17%.* |

| GAAP operating margin was 26.8%, compared to 25.5% in fiscal year 2021. Adjusted operating margin for fiscal year 2022 decreased to 38.3%, compared to 39.1% in the prior year, unfavorably impacted by foreign currency exchange, the full-year impact of the prior year’s Asuragen acquisition, and strategic investments.* |

| * | See Appendix A for a reconciliation of adjusted financial measures to GAAP for 2022 and 2021 fiscal years. |

| 2022

Proxy Statement 5

| 2022

Proxy Statement 5

Long-Term Performance

Our record of delivering strong shareholder returns reflects our commitment to creating long-term shareholder value.

Governance Highlights

| BOARD COMPOSITION | BOARD ACCOUNTABILITY | |

• Eight of nine directors are independent

• Separate Board Chair and CEO roles

• All chairs and members of all Board committees are independent

• Balance of industry, scientific, and functional expertise among directors

• Policy requiring directors to retire when they reach the age of 75

• Regular refreshment, with a current average tenure of 11 years of service

|

• Annual election of directors

• Majority voting in uncontested director elections (through director resignation policy)

• Annual Board and committee evaluations

• Regular executive sessions of non-management directors

• Stringent executive and director equity ownership guidelines

• Ongoing shareholder engagement program includes active director participation

| |

| SHAREHOLDER INTERESTS | RISK MANAGEMENT | |

• Second Corporate Sustainability Report to be issued in fall of 2022

• Annual “say-on-pay” vote

• One single voting class of common stock

• No shareholder rights plan

• Proxy access to nominate director candidates

• Shareholders have right to call a special meeting

|

• Risk assessment and oversight is an integral part of Board and committee deliberations throughout the year

• Management gives periodic reports to the Board on cybersecurity, privacy, environmental and compliance risks

• Compensation Committee oversees compensation and other risks related to human capital management

• Audit Committee oversees financial, fraud, and conflicts risks, as well as financial impacts related to compliance and cyber incidents

• Nominations and Governance Committee oversees company culture, ethics, conflicts of interest, and other governance risks |

| 2022

Proxy Statement 6

| 2022

Proxy Statement 6

Shareholder Engagement Highlights

Bio-Techne values hearing shareholder perspectives. Management meets frequently with key shareholders to discuss the Company’s financial performance and strategies, executive compensation, governance, and social and environmental issues.

67%

of shareholders of Bio-Techne’s outstanding common stock met with management and directors

during 2022

One of the goals of those engagements was to understand shareholder concerns that led to a disappointing say-on-pay vote at our most recent annual meeting of shareholders. While some shareholders expressed concerns about certain elements of our executive compensation program, shareholders were generally positive about Bio-Techne’s financial performance and governance positions, as well as our initiatives with respect to sustainability.

Many of the changes we have made to our corporate governance practices recently are the direct result of feedback from shareholders and other stakeholders, including:

| • | Allocating and clarifying oversight responsibilities for sustainability-related risks and activities |

| • | Clarifying that the full Board retains oversight of cyber-related risks and mitigation measures, while the Audit Committee oversees management’s response to cyber incidents |

| • | Increasing the levels of share ownership directors and executive officers are required to maintain within five years of assuming office—tripling the ownership guidelines for directors and executive officers, and increasing the ownership guidelines for the CEO from 3 times base salary to 6. |

| • | Amending the bylaws to clarify the process for shareholder nominations of director candidates and submissions of shareholder proposals, as well as the procedures for shareholders to call a special meeting. |

For a detailed discussion of our engagement specifically on executive compensation matters, see “Compensation Discussion & Analysis—Addressing Shareholder Concerns,” which begins on page 33 .

| 2022

Proxy Statement 7

| 2022

Proxy Statement 7

Information About The Nominees

The following is an overview of our nominees for election as directors at the 2022 Annual Meeting. Directors are elected annually by a majority of votes cast. All of the nominees are independent except Mr. Kummeth.

| Committee Membership | ||||||||||||||||||

| Name and Principal Occupation |  |

|

|

|

|

Director Since |

Age | Gender | Under- represented Minority | |||||||||

| Robert

V. Baumgartner Former Executive Chairman, Center for Diagnostic Imaging |

0 |  |

|

2003 | 66 | M | ||||||||||||

| Julie L. Bushman Former EVP International Operations, 3M |

2 |  |

2020 | 61 | F | |||||||||||||

| John L. Higgins President and CEO, Ligand Pharmaceuticals |

1 |  |

|

2009 | 52 | M | ||||||||||||

| Joseph D. Keegan Advisor and Board Director |

1 |  |

2017 | 69 | M | |||||||||||||

| Charles R.

Kummeth President and CEO, Bio-Techne Corporation |

1 | 2013 | 62 | M | ||||||||||||||

| Roeland Nusse Professor, Stanford University |

0 |  |

2010 | 72 | M | |||||||||||||

| Alpna Seth Former President and CEO, Nura Bio Inc. |

1 |  |

|

2017 | 59 | F |  | |||||||||||

| Randolph Steer Biotechnology Consultant and Board Director |

0 |  |

|

1990 | 72 | M | ||||||||||||

| Rupert Vessey President of Global Research & Early Development, Bristol Myers Squibb |

0 |  |

|

2019 | 57 | M | ||||||||||||

|

Member |  |

Committee Chair |

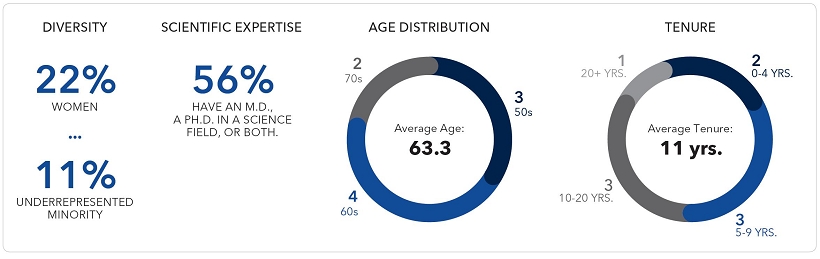

Our strong performance during fiscal year 2022 can be partially attributed to our experienced board of directors. As shown below, our predominantly independent board includes a range of newer and tenured directors with a balanced and diverse mix of experience, education, and talents.

| 2022 Proxy Statement 8

| 2022 Proxy Statement 8

Director Qualifications and Experience

Below is a snapshot of the skills and experience of the Board nominees

Sustainability Highlights

During fiscal 2022, we made significant progress identifying, documenting, and (when possible) measuring our ongoing efforts to become a better corporate citizen. We group our sustainability commitments into four key pillars:

|

|

|

|

| Our People | Advancing Science | Governance & Operational Integrity | The Environment |

Our 2022 Corporate Sustainability Report, which will be published this fall, includes details on the progress the Bio-Techne team has made in each of these key pillars in the past few years. This latest sustainability report will include increased disclosure regarding our fourth pillar, The Environment. For the first time, we are including an inventory of our Scope I and Scope II greenhouse gas (GHG) emissions data for our largest U.S.- and European-based manufacturing facilities. Products manufactured in these facilities accounted for 99% of Bio-Techne’s fiscal 2022 revenue.

| 2022 Proxy Statement 9

| 2022 Proxy Statement 9

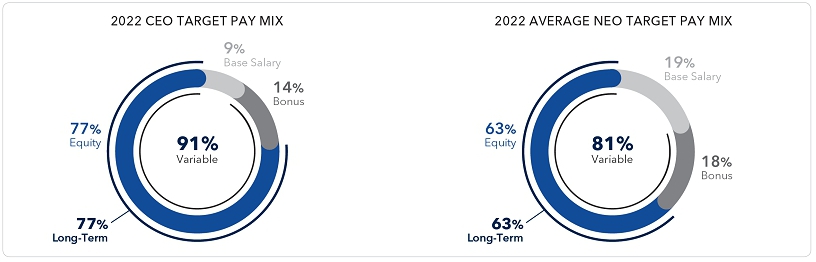

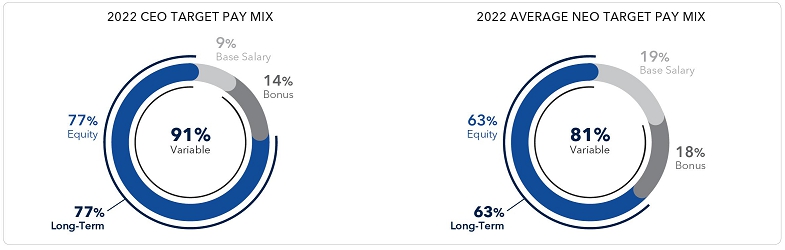

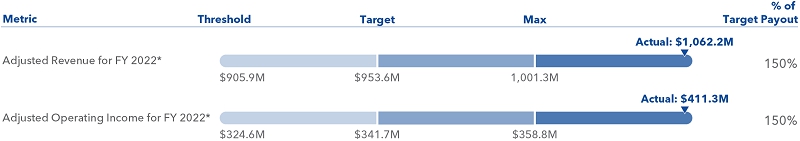

Executive Compensation Highlights

With our strategic focus on growing the business over the long term, our executive compensation program motivates our talented management team by rewarding successful execution of our short-term business plans and our longer-term sustainable strategies. Moreover, our executive pay program has a strong pay-for-performance foundation, aligned to the financial goals we believe are most effective at driving long-term shareholder value creation, so that executives and long-term shareholders alike can benefit from Bio-Techne’s success and growth. Consequently, while the balance of the components in our compensation program may change slightly from year to year, our executives’ total pay mix is heavily weighted toward at-risk, performance-based compensation elements.

| Type | Element | Objective | ||||

|

Fixed | Base Salary | Recognizes an individual’s role and responsibilities and serves as an important retention vehicle | |||

| Performance-based | Annual Bonus | Rewards achievement of annual Company-wide and segment financial objectives for revenue and operating income | ||||

|

Performance-based | Performance-based Share Options and Restricted Share Units | Supports the achievement of corporate strategic goals for long-term revenue and operating income that drive the creation of long-term, sustainable shareholder value | |||

| Performance- and Time-based | Time-Based Share Options and Restricted Share Units | Aligns the interests of management and shareholders and serves as an important retention vehicle |

The performance measures that apply to annual and long-term incentive awards—revenue and operating income—reflect our focus on both organic top-line growth and operational efficiency and profitability. Both measures represent cash generation, which we believe drives external valuation of the Company and therefore shareholder value.

Pay for Performance Alignment

The following graph illustrates Bio-Techne’s TSR performance compared to reported pay for our CEO over the past five years. As indicated, the increase in value created for shareholders has far outpaced the increases in Mr. Kummeth’s compensation over that time period, despite the fiscal year 2022 reduction in TSR.

| 2022 Proxy Statement 10

| 2022 Proxy Statement 10

Proposal 1. Set the Number of Directors at Nine

|

THE BOARD RECOMMENDS A VOTE FOR SETTING THE NUMBER OF DIRECTORS AT NINE. |

We believe that a nine-member Board continues to be the most effective size for Bio-Techne.

Our bylaws provide that the number of directors must be determined by shareholders at each Annual Meeting. Your Board unanimously recommends that the number of directors be set at nine. Approval of this proposal requires the affirmative vote of the holders of the greater of (1) a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting with authority to vote on such matter and (2) a majority of the voting power of the minimum number of shares that would constitute a quorum for the transaction of business at the Annual Meeting.

Proposal 2. Elect the Nine Director Nominees Identified in this Proxy Statement, Each for a Term of One Year

|

THE BOARD RECOMMENDS A VOTE FOR EACH OF THE NINE DIRECTOR NOMINEES. |

Our nominees constitute a diverse group of exemplary leaders who bring a range of relevant skills and expertise to their roles.

The nine directors elected at this Annual Meeting will hold office until the 2023 Annual Meeting of Shareholders and until their successors have been elected and qualified or until their earlier death, resignation, or removal. Each nominee has agreed to serve as a director if elected. If any nominee declines or becomes unable or unavailable to serve as a director for any reason, the individual(s) designated as your proxy will be authorized, in their discretion, to vote for a replacement nominee if the Board names one. As an alternative, the Board may reduce the number of directors to be elected at the Annual Meeting.

If the number of director nominees is equal to (or less than) the number of directors to be elected (known as an “uncontested election”), directors will be elected by a majority vote; directors who receive a greater number of “FOR” votes than “AGAINST” votes will be elected. In an uncontested election, an incumbent director who does not receive a majority of the votes cast “FOR” his or her election must offer to tender a resignation to the Board’s Nominations and Governance Committee. The Board, taking into account the recommendation of the Nominations and Governance Committee, will act on a tendered resignation and publicly disclose its decision within 90 days of receiving certification of the election results. If the Board does not accept such a resignation, the director will continue to serve until the next annual meeting and until a successor is duly elected.

If the number of director nominees exceeds the number of directors to be elected (a “contested election”), directors will be elected by a plurality of votes cast.

| 2022 Proxy Statement 11

| 2022 Proxy Statement 11

Board Refreshment

The Board continues to consider regular refreshment of its membership as an important governance consideration. Over the last nine years, as the Company’s size and scope have significantly expanded, we have undergone a thoughtful, gradual board refreshment process. In 2014, we implemented a provision in our Principles of Corporate Governance providing that director nominees, including incumbent directors, may not be older than 74. As a result, four independent directors have retired and been replaced over the past eight years, and the average director tenure has dropped from 13 years in 2014 to approximately 11 years currently. We expect to continue this refreshment process as two of the current eight independent directors reach retirement age.

Qualities of Prospective Nominees

The Nominations and Governance Committee periodically assesses the appropriate size of the Board of Directors, whether any vacancies are expected due to retirement or otherwise, and the skills and experience needed of directors to properly oversee Bio-Techne’s short- and long-term interests. If vacancies are anticipated, or otherwise arise, the Nominations and Governance Committee considers multiple potential candidates for director. Candidates may come to the Committee’s attention through current members of the Board of Directors, professional search firms, shareholders, or other sources, and may be considered at any point during the year. The ultimate goal is to maintain a well-rounded Board that functions collegially and independently.

Candidates for the Board are considered and selected on the basis of criteria including outstanding achievement in their professional careers; experience; wisdom; personal and professional integrity; the ability to make independent, analytical inquiries; and an understanding of the business environment. Candidates must have the experience and skills necessary to understand the Company’s principal operational and functional objectives and plans, results of operations and financial condition, and position in our industry. Candidates also must have a perspective that will enhance the Board’s strategic discussions and be capable of and committed to devoting adequate time to Board duties. With respect to incumbent directors, the Nominations and Governance Committee also considers past performance on the Board and contributions to the Company, in part through an annual assessment process.

| 2022 Proxy Statement 12

| 2022 Proxy Statement 12

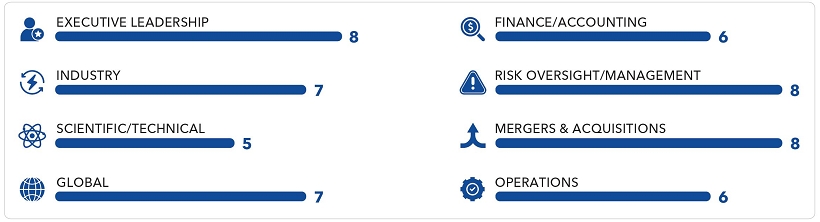

Relevant Skills and Experience

As a highly acquisitive science-based company, we seek to have a board with a mix of science/technology and business expertise. Our directors reflect this balance, and also have a diverse mix of other skills and experience needed to help drive our strategies. The following describes the specific skills and experience we seek in directors to support the Company’s strategic vision and business, and the number of our director nominees with each skill.

8 of 9 |

|

7 of 9 |

|

5 of 9 |

|

7 of 9 |

| |||

| Executive Leadership | Industry | Scientific/Technical | Global | |||||||

| Senior level managerial experience brings a broad perspective and knowledge to engage with management in meaningful discussions of our strategy and related strategic risks, including people management. | The life science tools and diagnostics industry is complex and technology-focused, so having directors with experience in this business, either as executives or customers, is a significant advantage. | Many of our strategic decisions, including especially our M&A initiatives, require significant understanding of advanced scientific knowledge. | Knowledge about operating outside the U.S. is important as we face the complexities of global markets, especially considering almost half of our business comes from outside the United States and our strategies include expansion into additional international markets. | |||||||

6 of 9 |

|

8 of 9 |

|

8 of 9 |

|

6 of 9 |

| |||

| Finance/Accounting | Risk Oversight/ | Mergers & Acquisition | Operations | |||||||

| Familiarity with complex financial and accounting concepts and a deep understanding of financial statements are vital for helping the Board perform its oversight function. | Management An understanding of how to identify, assess, and mitigate risks is a key attribute—particularly for a growth-oriented company such as Bio-Techne. |

Since one of our key growth strategies is to acquire companies that expand our product offerings and increase revenue, experience with assessing acquisition opportunities and risks is an important oversight capability. | We make and sell hundreds of thousands of different products, including some that are regulated by the FDA, so having directors who understand the manufacturing and supply chain complexities of our operations helps us identify associated strategic risks and opportunities. | |||||||

| 2022 Proxy Statement 13

| 2022 Proxy Statement 13

Director Diversity

While the Company does not have a formal diversity policy for Board membership, we seek directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. The Nominations and Governance Committee considers, among other factors, diversity with respect to perspectives, backgrounds, skills, and experience in its evaluation of candidates for Board membership. Such diversity considerations are discussed in connection with the general qualifications of each potential nominee. At the recommendation of the Nominations and Governance Committee, the Board last year amended its Principles of Corporate Governance to formalize Bio-Techne’s commitment to diversity in all respects, including specifically diversity of gender, ethnicity, and race. This year for the first time, the Board asked directors to voluntarily disclose information to help assess their status as underrepresented minorities. The Company is committed to actively seeking out highly qualified diverse candidates, including women and minority candidates, to include in the pool from which Board nominees are chosen.

Shareholder Recommendations of Nominees

Shareholders are welcome to recommend candidates for consideration by the Nominations and Governance Committee. Recommendations may be sent to the attention of the Nominations and Governance Committee at the Company’s address: 614 McKinley Place N.E., Minneapolis, MN 55413. Any such recommendations should provide whatever supporting material the shareholder considers appropriate, but should at a minimum include background and biographical material so the Committee can make an initial determination as to whether the prospective nominee satisfies our criteria for directors. The Nominations and Governance Committee will apply the same criteria in evaluating candidates recommended by shareholders as it uses for candidates that come to the Committee’s attention from other sources.

Shareholders who intend to directly nominate a candidate for election by the shareholders at the Annual Meeting (rather than recommending the candidate to the Nominations and Governance Committee) must comply with the procedures described later in this Proxy Statement under “Additional Corporate Governance Matters—Shareholder Proposals for 2023 Meeting” and with Bio-Techne’s bylaws.

| 2022 Proxy Statement 14

| 2022 Proxy Statement 14

We believe all of our director nominees bring to our Board the practical wisdom and strong professional characteristics, judgment, and leadership abilities necessary to keep Bio-Techne performing competitively in the market. The following biographies describe the nominees’ noteworthy experience, individual qualifications, and skills that we believe contribute to our Board’s effectiveness and success.

| Robert V. Baumgartner | ||

Age: 66 Director Chair INDEPENDENT

|

Professional Background From 2001 until July 2019, Mr. Baumgartner served as Executive Chairman, Director of the Center for Diagnostic Imaging, Inc., an operator of diagnostic imaging centers. Prior to August 2015, Mr. Baumgartner also served as Chief Executive Officer of that company. Before joining the Center for Diagnostic Imaging, he held numerous executive positions, including Chief Executive Officer and Director of American Coating International, President and Chief Executive Officer of First Solar, and President of the Apogee Glass Group. Mr. Baumgartner began his professional career at KPMG LLP, an international accounting firm.

Other Affiliations Mr. Baumgartner currently serves as a director of the boards of Carestream and OIA Global, both privately-held companies, and serves as an advisor to Sirona Medical.

Education Bachelor’s degree in business administration, University of Notre Dame.

Key Experience and Qualifications

Mr. Baumgartner brings to the Board valuable strategic skills and financial and operational management expertise. His more than 20 years serving as Chief Executive Officer and Executive Chairman of large, complex businesses gives him extensive experience in finance, accounting, and business leadership. Mr. Baumgartner also offers important board-level experience, as well as knowledge of Bio-Techne’s business and industry gleaned in his years serving on the Board. | |

| Julie L. Bushman | ||

Age: 61 Director Other Public Boards • Adient, plc. (since 2016) • Phillips 66 (since 2020) INDEPENDENT |

Professional Background Ms. Bushman retired in February 2020 from 3M Corporation, where she most recently served as Executive Vice President of International Operations. She joined 3M in 1983, and served in various executive positions, including Senior Vice President of Business Transformation and Information Technology; Executive Vice President of Safety, Security and Protection Services; Executive Vice President of Safety and Graphics; Division Vice President of the Occupational Health and Environmental Safety Division; and Chief Information Officer.

Education Bachelor of Science, University of Wisconsin-River Falls.

Key Experience and Qualifications

In her various roles with 3M, Ms. Bushman developed extensive global experience from managing international operations and a global business in personal safety. She also has broad digital, software, and CIO experience, which bring important expertise in IT and cybersecurity matters as the Company continues to expand globally and integrate systems to increase operational efficiencies. Her experience with public company requirements as both an executive officer and as a director is also valuable. | |

|

Executive Leadership |  |

Industry |  |

Scientific/Technical |  |

Global | ||||

|

Finance/Accounting |  |

Risk Oversight/Management |  |

Mergers & Acquisitions |  |

Operations |

| 2022 Proxy Statement 15

| 2022 Proxy Statement 15

| John L. Higgins | ||

Age: 52 Director Other Public Boards • Ligand Pharmaceuticals, Inc. (since 2007) INDEPENDENT |

Professional Background Mr. Higgins has been President and Chief Executive Officer and a member of the Board of Directors of Ligand Pharmaceuticals, Inc. since 2007. From 1997 until joining Ligand, Mr. Higgins was with Connetics Corporation, a specialty pharmaceutical company, as its Chief Financial Officer, and also served as Executive Vice President, Finance and Administration and Corporate Development from 2002 until 2006. Mr. Higgins was previously a member of the executive management team and a director at BioCryst Pharmaceuticals, Inc., a biopharmaceutical company. Earlier in his career, Mr. Higgins was a member of the healthcare banking team of Dillon, Read & Co. Inc., an investment banking firm. Mr. Higgins has served as a director of numerous public and private companies.

Education Bachelor’s degree in economics, Magna Cum Laude, Colgate University.

Key Experience and Qualifications

Mr. Higgins offers the Board over 20 years of industry experience through his role as Chief Executive Officer of Ligand Pharmaceuticals and leadership roles in other pharmaceutical companies. His role with Ligand has given him vital experience in the application of strategic leadership skills within our industry, as well as extensive public company executive and board experience. | |

| Joseph D. Keegan, Ph.D. | ||

Age: 69 Director Other Public Boards • Interpace Diagnostics (since 2016) INDEPENDENT

|

Professional Background Dr. Keegan serves as a director and advisor for Interpace Diagnostics. From 2007 until 2012, Dr. Keegan served as President and Chief Executive Officer of ForteBio, Inc., a life science tools company. He joined ForteBio after serving as President and Chief Executive Officer of Molecular Devices Corporation from 1998 to 2007. Earlier in his career, Dr. Keegan held leadership positions at Becton Dickinson, Leica, Inc., and GE Medical Systems.

Other Affiliations Dr. Keegan has served on numerous public and private company boards of life science tools companies, including as Chair of Fluidic Analytics and Executive Chair of Halo Labs.

Education Ph.D. in Physical Chemistry, Stanford University.

Key Experience and Qualifications

Dr. Keegan brings an important life science background to the Board from his career working at a number of life sciences companies, with a focus on diagnostics. His knowledge of the Company’s customers and products is especially valuable. Dr. Keegan further offers extensive executive management experience and board-level experience through his past and present service on other private and public company boards. | |

|

Executive Leadership |  |

Industry |  |

Scientific/Technical |  |

Global | ||||

|

Finance/Accounting |  |

Risk Oversight/Management |  |

Mergers & Acquisitions |  |

Operations |

| 2022 Proxy Statement 16

| 2022 Proxy Statement 16

| Charles R. Kummeth | ||

Age: 62 Director Other Public Boards • Gentherm, Inc. (since 2018) |

Professional Background Mr. Kummeth has been President, Chief Executive Officer, and member of Bio-Techne’s Board since 2013. Prior to joining the Company, he served in executive roles at Thermo Fisher Scientific Inc., including President of Mass Spectrometry and Chromatography and President of the Laboratory Consumables Division. Prior to joining Thermo Fisher, Mr. Kummeth served in various roles during a 24-year career at 3M Corporation, most recently as Vice President of the Medical Division.

Education Master of Science in computer science, University of St. Thomas, and Master of Business Administration, Carlson School of Business at the University of Minnesota.

Key Experience and Qualifications

As the only member of management to serve on the Board, Mr. Kummeth provides key insight into the Company’s day-to-day operations, challenges, and opportunities. Mr. Kummeth’s service on the Board also promotes strategy development and implementation and facilitates the flow of information between the Board and management. Mr. Kummeth further offers extensive significant executive management experience and expertise leading the growth of biotechnology companies. | |

| Roeland Nusse, Ph.D. | ||

Age: 72 Director INDEPENDENT

|

Professional Background Dr. Nusse has been a professor or associate professor in the Department of Developmental Biology at Stanford University and an investigator at the Howard Hughes Medical Institute since 1990. He has also been the chair of the Department of Developmental Biology at Stanford since 2007. Dr. Nusse previously was at the Netherlands Cancer Institute (in Amsterdam) as a staff scientist and ultimately served as head of the Department of Molecular Biology. Dr. Nusse was awarded the Breakthrough Prize in Life Sciences in 2016.

Other Affiliations Dr. Nusse was elected to the United States National Academy of Sciences in 2010, the European Molecular Biology Organization in 1988, the Royal Dutch Academy of Sciences in 1997, and the American Academy of Arts and Sciences in 2001.

Education Ph.D. in molecular biology, Netherlands Cancer Institute.

Key Experience and Qualifications

Dr. Nusse brings valuable experience to the Board from his longstanding career as a researcher and department chair at Stanford University, including strategic leadership and scientific and industry knowledge, which gives him insight into the Company’s products, customers, and markets. Dr. Nusse also has a deep understanding of and contacts within the international life science research community. | |

|

Executive Leadership |  |

Industry |  |

Scientific/Technical |  |

Global | ||||

|

Finance/Accounting |  |

Risk Oversight/Management |  |

Mergers & Acquisitions |  |

Operations |

| 2022 Proxy Statement 17

| 2022 Proxy Statement 17

| Alpna Seth, Ph.D. | ||

Age: 59 Director Other Public Boards • SeaGen, Inc. (since 2018) INDEPENDENT

|

Professional Background Dr. Seth recently retired as President and Chief Executive Officer of Nura Bio Inc., a biopharmaceutical company focused on the discovery of novel neuroprotective drugs, where she served for three years. From July 2017 through 2018, she was Chief Operating Officer of Vir Biotechnology, Inc., an immunology company. Prior to joining Vir, Dr. Seth was at Biogen Inc. for nearly two decades, most recently as Senior Vice President and Global head of the Biosimilars business, headquartered in Switzerland. For the period from 1998 through 2014, Dr. Seth held a range of senior leadership roles across R&D and commercial arenas. In this capacity, she led several major drug development programs and product launches, along with strategic, business development, and long-range planning initiatives. In another international general management assignment, Dr. Seth served as the founding Managing Director of an India affiliate and was a member of Biogen’s Asia Pacific Leadership Team.

Education Ph.D. in Biochemistry and Molecular Biology, University of Massachusetts Medical School. Conducted post-doctoral research at Harvard University in Immunology and Structural Biology, both as a Howard Hughes Medical Institute Fellow.

Key Experience and Qualifications

Dr. Seth brings a breadth of experience in research, drug discovery, marketing, international operations, financial management, and business development. Her extensive background in the pharmaceutical industry and in international business and her deep knowledge of critical areas of science provide a valuable strategic perspective for our business generally and for a key customer group. | |

| Randolph Steer, M.D., Ph.D. | ||

Age: 72 Director INDEPENDENT

|

Professional Background Dr. Steer is an independent biotechnology consultant and board director. He served as President and Chief Operating Officer of Capstone Therapeutics Corp. from 2006 to 2011. From 1989 to 2006 Dr. Steer was a consultant to the pharmaceutical and biotechnology industries, advising companies in business development, medical marketing, and regulatory and clinical affairs. His prior experience includes service as Associate Director of Medical Affairs at Marion Laboratories and as Medical Director at Ciba Consumer Pharmaceuticals.

Other Affiliations Dr. Steer was elected to the Mayo Clinic Board of Trustees in 2011, and previously served as a director of publicly-traded Vital Therapies, Inc. (now Immunic, Inc.).

Education Ph.D. in pathobiology, University of Minnesota, and medical degree from the Mayo Medical School.

Key Experience and Qualifications

Dr. Steer offers the Board a strong medical and scientific background. Moreover, his experience in executive leadership and in board management, together with his knowledge of the pharmaceutical and biotechnology industries, enable him to provide valuable strategic insight. As the longest tenured member of the Board, Dr. Steer also offers an understanding of the Company’s development. | |

|

Executive Leadership |  |

Industry |  |

Scientific/Technical |  |

Global | ||||

|

Finance/Accounting |  |

Risk Oversight/Management |  |

Mergers & Acquisitions |  |

Operations |

| 2022 Proxy Statement 18

| 2022 Proxy Statement 18

| Dr. Rupert Vessey, MA, BM BCh, FRCP, DPhil | ||

Age: 57 Director INDEPENDENT

|

Professional Background Dr. Vessey has been the President of Research and Early Development at Bristol-Myers Squibb since 2019. Previously, he was President of Global Research and Early Development at Celgene from 2015 to 2019. During that time, Dr. Vessey also served on the board of Juno Therapeutics for one year. Before joining Celgene, Dr. Vessey held various research and development senior management positions during his 10-year tenure at Merck.

Other Affiliations Dr. Vessey is a member of the Royal College of Physicians of London UK. He serves on the Board of Pharmakea, a privately-held therapeutics company.

Education MA in physiological sciences and BM BCh in clinical medicine from Oxford University. DPhil at the Institute for Molecular Medicine, Oxford.

Key Experience and Qualifications

Dr. Vessey was selected to serve on the Board because of his exceptional background in medical and life science research and development with Bristol-Myers Squibb, Celgene, Merck, and other companies, and his extensive experience as an executive in the pharmaceutical industry, a key customer group for the Company. His international research and business experience is also important to the Board as the Company continues to expand in markets outside of the United States. | |

| Board Diversity Matrix (As of June 30, 2022) | ||||

| Total Number of Directors | 9 | |||

| Female | Male | |||

| Part I: Gender Identity | ||||

| Directors | 2 | 7 | ||

| Part II: Demographic Background | ||||

| Asian | 1 | 0 | ||

| White | 1 | 7 | ||

|

Executive Leadership |  |

Industry |  |

Scientific/Technical |  |

Global | ||||

|

Finance/Accounting |  |

Risk Oversight/Management |  |

Mergers & Acquisitions |  |

Operations |

| 2022 Proxy Statement 19

| 2022 Proxy Statement 19

The Board of Directors is Bio-Techne’s governing body, with responsibility for oversight, counseling, and direction of management to serve the short- and long-term interests of the Company and its shareholders. The Board’s goal is to build long-term value for shareholders and to ensure Bio-Techne’s vitality for the customers, employees, and other individuals and organizations that depend on us. To achieve that goal, the Board monitors both the performance of the Company and the performance of the CEO. The Board also is integrally involved in strategic planning and enterprise risk management, in partnership with the management team. It regularly undertakes an in-depth review of management’s long term and short-term strategic plan, and periodically provides input as the strategic plan is implemented and evolves.

The Board recently revised and refreshed its Principles of Corporate Governance, which can be found on the Investor Relations page of our website at www.bio-techne.com. The Principles of Corporate Governance describe the Company’s corporate governance practices and policies and provide a framework for Bio-Techne’s governance. Among other things, they establish requirements and qualifications for members of the Board and specify the Board’s leadership structure and standing committees.

The Bio-Techne Code of Ethics and Business Conduct and the charters for each of the Board’s four standing committees also are available on our website under “Investor Relations—Governance.”

Bio-Techne’s Principles of Corporate Governance provide that a majority of the Board must be independent directors under criteria established by the Board in conformity with the listing rules of the Nasdaq Stock Market. The Nominations and Governance Committee annually reviews the independence of each director, including whether there are any related party transactions. In making its independence determinations, the Nominations and Governance Committee reviewed transactions and relationships between each director or any member of a director’s immediate family on one side, and the Company or any of its subsidiaries on the other side, based on information provided by the directors and from Company records and publicly available information. The Committee determined and the Board confirmed that all of the Company’s non-employee directors are independent.

| 2022 Proxy Statement 20

| 2022 Proxy Statement 20

Bio-Techne’s Principles of Corporate Governance do not require the roles of CEO and Chair to be separate or combined. Instead, they assign to the Nominations and Governance Committee the responsibility of periodically assessing the needs of the Board and determining whether the leadership structure in place at the time is appropriate.

For now, the Board has determined that separating the roles of Chair and CEO and maintaining a majority independent Board supports the Board’s independent oversight of management, ensures that the appropriate level of independence is applied to all Board decisions, and is the most effective leadership structure for the Company.

|

Robert V. Baumgartner |  |

Charles R. Kummeth | |||

| Independent Chair of the Board | President & CEO | |||||

|

• assists the Nominations and Governance Committee with succession planning for the CEO • sets the agenda for Board meetings • presides over meetings of the full Board • presides over executive sessions of the independent directors |

• executes the Board’s direction • is responsible for the day-to-day leadership and performance of the Company

|

To bolster the Board’s independent oversight, each of the four Board committees consists entirely of independent directors.

Risk assessment and oversight is an integral part of Board and committee deliberations throughout the year. The Board administers some of its risk oversight function through its committees, as described below.

| The Board of Directors |

| Some categories of risk—those related to strategy, technology, cybersecurity, and operations, and those arising from environmental and social matters—are reviewed directly by the entire Board. In performing their oversight responsibilities, the Board and its committees review policies and guidelines that senior management use to manage Bio-Techne’s exposure to material categories of risk. In addition, the Board and its committees review the performance and execution of the Company’s overall risk management function and management’s establishment of appropriate systems for managing risk. |

|

| The Audit Committee | The

Compensation Committee |

The

Nominations and Governance Committee |

The

Science and Technology Committee |

| has oversight responsibility with respect to the Company’s financial risk assessment and financial risk management. The Audit Committee meets regularly with management and the independent auditors to review the Company’s risk exposures, the potential financial impact those risks may have, the steps management takes to address those risks, and how management monitors emerging risks. Risk exposures may include compliance, legal, regulatory, and cyber incident risks, among others. | structures the Company’s compensation plans and programs to balance risk and reward, while mitigating the incentive for excessive risk-taking by our executive officers and employees. As part of its oversight of human capital management generally, the Compensation Committee also oversees non-compensation risks related to other elements of attracting and retaining talent. | oversees the management of risks associated with the composition and independence of the Board, as well as general corporate governance risks and policies. The Nominations and Governance Committee receives regular reports from management on the Company’s ethics and compliance programs and culture. | reviews the Company’s technology and scientific programs, including the risks associated with selecting and pursuing such programs in light of evolving customer needs and competitor activities. |

| 2022 Proxy Statement 21

| 2022 Proxy Statement 21

Each of the Board’s committees has risk oversight duties corresponding to its areas of responsibility, as described in its charter.

The risk oversight roles described above are not merely academic exercises. As we adjust to the changes resulting from the pandemic, for example, the Board continues to receive regular reports from management on the implications and effects of the pandemic on the Company’s business and provides guidance on management’s responses.

Each year, before beginning the nomination process, the Nominations and Governance Committee conducts an evaluation of the Board’s performance and reports to the Board respecting its conclusions and recommendations. Individual directors are assessed periodically as part of this evaluation. In addition, the Nominations and Governance Committee helps each other standing committee to periodically evaluate its performance.

The Board currently has four standing committees: Audit, Compensation, Nominations and Governance, and Science and Technology. Each committee is governed by a written charter that was approved by the Board and is reviewed annually. The four charters are available on our website at www.bio-techne.com in the “Investor Relations” section under “Corporate Governance.” The Board has, on occasion, established committees to deal with particular matters the Board believes appropriate to be addressed in that manner, but no such committees were created in fiscal year 2022.

Committee members are appointed by the Board each year, generally for a term of one year. The membership of each standing committee as of June 30, 2022, and the number of committee meetings held during fiscal year 2022, are shown below. The Board has determined that the members of all of the committees are independent.

| Director | Audit | Compensation | Nominations & Governance |

Science & Technology |

| Robert V. Baumgartner |  |

|

||

| Julie L. Bushman |  |

|||

| John L. Higgins |  |

|

||

| Joseph Keegan, Ph.D. |  |

|||

| Charles R. Kummeth | ||||

| Roeland Nusse, Ph.D. |  | |||

| Alpna Seth, Ph.D. |  |

| ||

| Randolph C. Steer, M.D., Ph.D. |  |

| ||

| Rupert Vessey, MA, BM BCh, FRCP, DPhil |  |

| ||

| Number of meetings held during FY 2022 | 8 | 4 | 3 | 2 |

|

Member |  |

Committee Chair |

| 2022 Proxy Statement 22

| 2022 Proxy Statement 22

| Audit Committee | |

|

Members: • John L. Higgins (Chair) • Robert V. Baumgartner • Julie L. Bushman NUMBER OF MEETINGS HELD DURING FY 2022: 8 |

The Audit Committee is responsible for: • appointing, supervising, and evaluating the Company’s independent registered public accounting firm; • reviewing the Company’s internal audit procedures and quarterly and annual financial statements; • monitoring the Company’s internal controls over financial reporting and the results of the annual audit; • overseeing the Company’s cash investment policy; and • monitoring cybersecurity incidents, our financial fraud hotline, and other compliance matters with a potential financial impact.

The Board has determined that each member of the Audit Committee meets the enhanced independence requirements prescribed by applicable rules of the Securities and Exchange Commission (“SEC”) and Nasdaq listing standards. In addition, for fiscal 2022, the Board has determined that Messrs. Baumgartner and Higgins are “audit committee financial experts” as such term is defined in applicable SEC rules. |

| Compensation Committee | |

|

Members: • Randolph Steer (Chair) • Joseph D. Keegan • Rupert Vessey NUMBER OF MEETINGS HELD DURING FY 2022: 4 |

The Compensation Committee is responsible for: • establishing the compensation and performance goals for the CEO; • working with the CEO to determine base and incentive compensation and performance goals for Bio-Techne’s other executive officers; • establishing overall policies for executive compensation; • reviewing the performance of the executive officers; • recommending to the Board and administering director compensation policies and practices; and • overseeing the Company’s management of human capital generally, including associated risks.

The Board has determined that each member of the Compensation Committee meets the enhanced independence requirements prescribed by applicable SEC rules and Nasdaq listing standards. |

| Nominations and Governance Committee | |

|

Members: • Robert V. Baumgartner (Chair) • John L. Higgins • Alpna Seth NUMBER OF MEETINGS HELD DURING FY 2022: 3 |

The Nominations and Governance Committee is responsible for: • recruiting well-qualified candidates for the Board • selecting individuals to be nominated for election as directors; • determining whether each member of the Board is independent; • establishing governance standards and procedures to support and enhance the performance and accountability of management and the Board • considering the composition of the Board’s standing committees and recommending any changes; • evaluating overall Board performance; • assisting committees with self-evaluations; • monitoring emerging corporate governance trends; and • overseeing the Company’s ethics program and monitoring the Company’s culture. |

| Science and Technology Committee | |

|

Members: • Roland Nusse (Chair) • Alpna Seth • Randolph Steer • Rupert Vessey NUMBER OF MEETINGS HELD DURING FY 2022: 2 |

The Science and Technology Committee is responsible for: • assisting the Board in providing oversight of management’s actions and judgments relating to the Company’s research and development activities, including its strategies, objectives, and priorities as they relate to current and planned R&D programs and technology initiatives; • assisting the Board in evaluating the scientific elements of the Company’s acquisitions and business development activities and risks related to research and development; and • reviewing and advising the Board and management on the Company’s overall intellectual property strategy. |

| 2022 Proxy Statement 23

| 2022 Proxy Statement 23

Bio-Techne values learning about shareholders’ perspectives. To that end, management meets frequently with key shareholders to discuss the Company’s financial performance and strategies. In addition, over the last several years, we have carried out and expanded a shareholder engagement program to discuss governance matters—both proactively and in response to requests from shareholders.

| Regular engagement — June |  |

| Reached out to shareholders owning over half of our outstanding shares |

Held meetings with shareholders representing over 40% of our outstanding shares |

Participants included members of management, the Board Chair (who also serves as chair of the Nominations & Governance Committee), and the chair of the Compensation Committee |

Topics included a business update and various governance, executive compensation, and sustainability issues |

Generally, shareholders were quite pleased with Bio-Techne’s financial and share performance, appreciated the leadership of current management and the Board, and did not express any notable concerns. There were several suggestions regarding our executive compensation program, which are addressed in detail in the Compensation Discussion and Analysis section under the heading “Addressing Shareholder Concerns,” which begins on page 33 .

As the 2021 Annual Shareholder Meeting approached, proxy advisory firms recommended opposing our say-on-pay proposal. In response, we conducted additional engagement discussions.

| Additional engagement before the Annual Shareholder Meeting — October |  |

| Connected with shareholders representing almost 40% of our outstanding shares, including several of our largest holders |

Participants included Investor Relations, the Corporate Secretary, and the chair of the Compensation Committee |

Focus was specifically on executive compensation |

Ultimately, 55.3% of shares outstanding voted in support of the Company’s say-on-pay proposal at the 2021 Annual Shareholder Meeting.

The Compensation Committee met in January 2022 to prepare for fiscal year 2022 executive compensation decisions. During that meeting, Dr. Steer reviewed with the Committee the results of the most recent say-on-pay vote, as well as information and perspectives shared by investors during the June and October engagements. The Compensation Committee then determined it would be prudent to reach out to shareholders for additional feedback relating to executive compensation.

| Post-meeting engagement at the request of the Compensation Committee — February and March |  |

| Reached out to shareholders representing over half of our outstanding shares |

Participants included Investor Relations, Corporate Secretary, and the chair of the Compensation Committee |

Spoke with shareholders representing about 26% of our shares outstanding |

For more information on our engagement related to executive compensation, see “Addressing Shareholder Concerns” in the Compensation Discussion and Analysis section below.

| 2022 Proxy Statement 24

| 2022 Proxy Statement 24

Bio-Techne conducts an orientation process for new directors that includes providing background materials and arranging meetings with senior management and visits to Company facilities. This orientation is designed to familiarize new directors with the Company’s strategic plans; significant financial, accounting, and risk management issues; code of ethics and compliance policies; principal officers and other senior management; and internal and independent auditors and legal counsel.

Thereafter, directors are expected to take such action, such as participating in continuing educational programs, as necessary to maintain the level of expertise required to perform their responsibilities as directors. Bio-Techne reimburses Board members for reasonable expenses relating to ongoing director education, subject to certain pre-approval requirements.

Service on Bio-Techne’s board requires a significant commitment of time and energy. Therefore, our Principles of Corporate Governance provide that directors may not serve on the boards of other companies if such service would impede their ability to effectively serve on the Company’s Board or would create any potential material conflicts. Directors must have approval from the Board Chair and the Chair of the Nominations and Governance Committee before agreeing to serve on the board of another company, and no independent director may serve on more than four other public company boards. Management personnel, including the Chief Executive Officer and President, may not serve on more than one additional public company board without the approval of the Chair of the Nominations and Governance Committee. In addition, executive officers and non-independent directors are prohibited from serving on the boards of any company where a Bio-Techne independent director is an executive officer.

The Board met four times during fiscal year 2022. Each director attended:

| 100% |  |

100% |

| OF THE BOARD MEETINGS | OF MEETINGS OF THE COMMITTEES ON WHICH HE OR SHE SERVED |

Directors meet their responsibilities not only by attending Board and committee meetings but also by conducting business via written actions in lieu of meetings. In addition, directors communicated informally throughout the year on various Board and committee matters with executive management, advisors, and others. All directors attended the Annual Meeting of Shareholders in October 2021.

The independent directors of the Board meet in executive session without members of management present on a regular basis. There were 4 such executive sessions in fiscal year 2022. The independent Chair presides over these sessions.

Communications from shareholders are always welcome. Communications should be addressed to our Corporate Secretary or Vice President of Investor Relations by email at IR@bio-techne.com or regular mail addressed to the Corporate Secretary, Bio-Techne Corporation, 614 McKinley Place N.E., Minneapolis, MN 55413. Communications are distributed to the Board or to one or more individual directors, as appropriate, depending on the facts and circumstances outlined in the communication. Communications regarding financial or ethical concerns will be forwarded to the chair of the Audit Committee. Communications such as business solicitations or advertisements, junk mail and mass mailings, new product suggestions, product complaints or inquiries, and resumes or other forms of job inquiries will not be relayed to the Board. In addition, material that is unduly hostile, threatening, illegal, or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any director upon request.

| 2022 Proxy Statement 25

| 2022 Proxy Statement 25

The Company believes that compensation for non-employee directors should be competitive and should encourage ownership of Bio-Techne shares. The Compensation Committee periodically reviews the level and form of director compensation and, if it deems appropriate, recommends changes to the Board.

Director compensation has not changed since 2020. Cash compensation for the non-employee directors was as follows:

| Every non-employee director | $75,000 |

| Board Chair | additional $120,000 |

| Chair of Audit Committee | additional $25,000 |

| Chair of Compensation Committee | additional $17,500 |

| Chairs of other committees | additional $15,000 |

These amounts are paid in monthly increments, and are pro-rated for a partial year of service if a director joins the Board other than by election at the annual meeting of shareholders. No additional compensation is paid for membership on committees or attendance at meetings.

In addition, on an annual basis, each non-employee director receives an equity grant valued at $200,000 (based on the closing price of Bio-Techne stock on the day of the annual meeting) that vests upon the sooner of the one-year anniversary of the grant date or the next annual shareholder meeting. Equity grants are provided 50% in stock options, with an exercise price equal to the fair market value of Bio-Techne’s common stock on the grant date, and 50% in restricted stock. Non-employee directors who join the Board other than by election at an annual meeting of shareholders receive a pro-rated equity grant based on the portion of the year they will serve.

Non-employee directors are reimbursed for the reasonable expenses they incur to attend Board and committee meetings.

Directors who are employees of Bio-Techne or its subsidiaries do not receive any additional compensation for service on the Board.

The Board recently updated the stock ownership guidelines for directors and executive officers to better align their interests with other shareholders. Non-employee directors are now required to own shares at least equivalent in value to five times their annual retainer within five years. All directors except Julie Bushman, who is the most recent addition to the Board, met the requirements as of June 30, 2022.

| 2022 Proxy Statement 26

| 2022 Proxy Statement 26

Directors who are not employees of the Company were compensated for fiscal year 2022 as follows:

| Name | Fees Earned or Paid in Cash(1) ($) | Share Awards(2) ($) | Option Awards(3) ($) | All Other Compensation(4) ($) | Total ($) | ||||||||||||||

| Robert V. Baumgartner | $ | 210,000 | $ | 99,957 | $ | 99,876 | $ | 311 | $ | 410,114 | |||||||||

| Julie L. Bushman | 75,000 | 99,957 | 99,876 | 311 | 275,144 | ||||||||||||||

| John L. Higgins | 100,000 | 99,957 | 99,876 | 311 | 300,144 | ||||||||||||||

| Joseph Keegan, Ph.D. | 75,000 | 99,957 | 99,876 | 311 | 275,144 | ||||||||||||||

| Roeland Nusse, Ph.D. | 90,000 | 99,957 | 99,876 | 311 | 290,144 | ||||||||||||||

| Alpna Seth, Ph.D. | 75,000 | 99,957 | 99,876 | 311 | 275,144 | ||||||||||||||

| Randolph C Steer, M.D., Ph.D. | 92,500 | 99,957 | 99,876 | 311 | 292,644 | ||||||||||||||

| Rupert Vessey, MA, BM BCh, FRCP, DPhi | 75,000 | 99,957 | 99,876 | 311 | 275,144 | ||||||||||||||

| (1) | Amounts consist of annual director fees and chair fees for services on the Company’s Board and its committees. For further information concerning such fees, see the discussion above this table. |

| (2) | The amounts represent the total grant date fair value of equity-based compensation for 194 shares of restricted stock granted pursuant to the Company’s 2020 Equity Incentive Plan in fiscal year 2022 at the grant date market value of $515.24 per share, in accordance with Financial Accounting Standards Board’s Accounting Standards Codification (ASC) Topic 718. As of June 30, 2022, each non-employee director held 194 unvested restricted shares. |

| (3) | The amounts represent the total grant date fair value of equity-based compensation for 633 stock option awards granted pursuant to the Company’s 2020 Equity Incentive Plan in fiscal year 2022, calculated in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification (ASC) Topic 718. Assumptions used in the calculation of these amounts are described in Note 10 to the Company’s audited financial statements for fiscal year 2022, included in the Company’s Annual Report on Form 10-K. As of June 30, 2022, the following non-employee directors held options to purchase the following number of shares of the Company’s common stock: Mr. Baumgartner-21,419; Mr. Higgins-28,819; Dr. Keegan-9,174; Dr. Nusse-25,419; Dr. Seth-4,151; Dr. Steer-17,419; Dr. Vessey-4,739; and Ms. Bushman-2,501. |

| (4) | Amounts represent the total dollar value of dividends paid on restricted share awards, as those amounts were not factored into the grant date fair value. |

| 2022 Proxy Statement 27

| 2022 Proxy Statement 27

We understand that delivering on our mission over the long term requires management to focus on corporate sustainability, including environmental, social, and governance (“ESG”) considerations. In fact, Bio-Techne has always operated with a focus on long-term, sustainable business success.

Beginning in 2020, we embarked on a journey to more specifically identify and evaluate those topics and initiatives that would sustainably drive stakeholder value. Our initial assessment resulted in a report that we published in the fall of 2020.

Since then, we have continued to build on our earlier work in four ways.

We formed a sustainability management and oversight infrastructure. Among other things:

| • | We allocated oversight responsibilities among the Board and its committees as described in “Corporate Governance—Risk Oversight” above. |

| • | We ensured senior management oversight by creating a Sustainability Oversight Council which is led by the General Counsel and made up of the CEO and others in executive leadership. The Sustainability Oversight Council is charged with leading ESG strategies and managing the various initiatives. |

| • | We created a cross-functional Sustainability Working Group that is charged with managing various ESG initiatives and refreshing disclosure of ESG data and efforts. |

We undertook a more robust materiality assessment. This assessment included an evaluation against the appropriate standards published by the Sustainability Accounting Standards Board, review of various stakeholder interests, conversations with our largest shareholders, and an analysis of peer disclosures and industry best practices, leading to some modifications to our ESG reporting structure and areas of focus.

We undertook several new initiatives and data projects. These efforts were focused particularly in the areas of human capital management and environmental practices.

We substantially improved our disclosure of ESG matters. Bio-Techne’s 2022 Corporate Sustainability Report will be available on our website at www.bio-techne.com/corporate-and-social-responsibility later in September. It builds on our most recent report in 2020 by adding disclosure about our GHG emissions and additional disclosure regarding human capital, governance, and the role of our products in advancing science and healthcare.

| 2022 Proxy Statement 28

| 2022 Proxy Statement 28

As we considered how to improve our ESG efforts and disclosures, we continued to focus on our “Four Pillars” of corporate sustainability shown below, although these were somewhat modified from our original report in 2020.

| Pillar | Commitment | Description |

Pillar One

|

Our People | Everything starts with our people. Without our dedicated, passionate, and innovative Bio-Techne team members, we would not be developing the tools that academic and biopharma researchers rely on every day to push science forward. Our four key EPIC values (Empowerment, Passion, Innovation, and Collaboration) are the backbone for the way we approach everything related to our people. As a global science organization, we value continuous learning and development opportunities for our employees, as well as a diverse and inclusive work environment that respects employees from all cultures and backgrounds. |

Pillar Two

|

Advancing Science | Bio-Techne has a 46-year history of developing innovative and cutting-edge tools to advance biopharmaceutical and academic scientific discoveries and technologies to enable and improve disease diagnosis. Our commitment to advancing science goes beyond developing the products the scientific community needs to drive discoveries, and extends to delivering these products with a focus on sustainability, quality, responsible sourcing, and a commitment to continuously improving how we package our products to minimize our environmental footprint. |

Pillar Three

|

Governance and Operational Integrity | We adhere to many governance best practices, which we believe form an important foundation for actions and decisions of management and the Board in the best interests of all of our stakeholders. We also are committed to ethical and legal conduct and have implemented policies and processes to ensure our partners and suppliers operate with integrity as well. |

Pillar Four

|

The Environment | We care about minimizing the environmental impacts of our operations, conserving natural resources, and providing effective stewardship of the environment. Our commitment to environmental sustainability is demonstrated through our ISO 14001 certifications at our Minneapolis, Minnesota headquarters and our European headquarters in the UK, as well as our efforts to begin collecting data on Scopes 1 and 2 greenhouse gas emissions and disclosing that data. |

Information about our sustainability efforts is posted on our website, at https://bio-techne.com/about/corporate-and-social-responsibility, and includes additional detail that is not part of or incorporated by reference into this Proxy Statement.

| 2022 Proxy Statement 29

| 2022 Proxy Statement 29